For financial institutions and new-age lenders, a modern Loan Management System (LMS) is an indispensable tool that streamlines their entire loan lifecycle – from loan application to repayment. With the right LMS, you can manage loans effectively, reduce manual errors, improve customer experience and stay compliant. Allied Market Research estimates that the Loan Management System market is expected to reach approximately $30b by 2031, driven by the increasing demand for lending automation.

In this blog, you will discover what a Loan Management System is, its key modules, features and how it benefits MSME lenders .

What is a Loan Management System?

A Loan Management System (LMS) is a comprehensive software platform designed to manage the entire post-loan disbursal process. It streamlines and automates key functions such as loan servicing, debt management, collections, compliance tracking, and reporting. By handling tasks that occur after loan approval, an LMS ensures efficient, compliant, and effective loan management, enabling lenders to maintain accurate records, improve borrower satisfaction, and reduce operational risks.

With such a system you can:

- Easily track loans, ensure timely payments and maintain accurate records.

- Improve communication between lenders and borrowers, making the loan management process more efficient and less prone to manual errors.

- Upgrade your operational efficiency and handle higher loan volumes with ease.

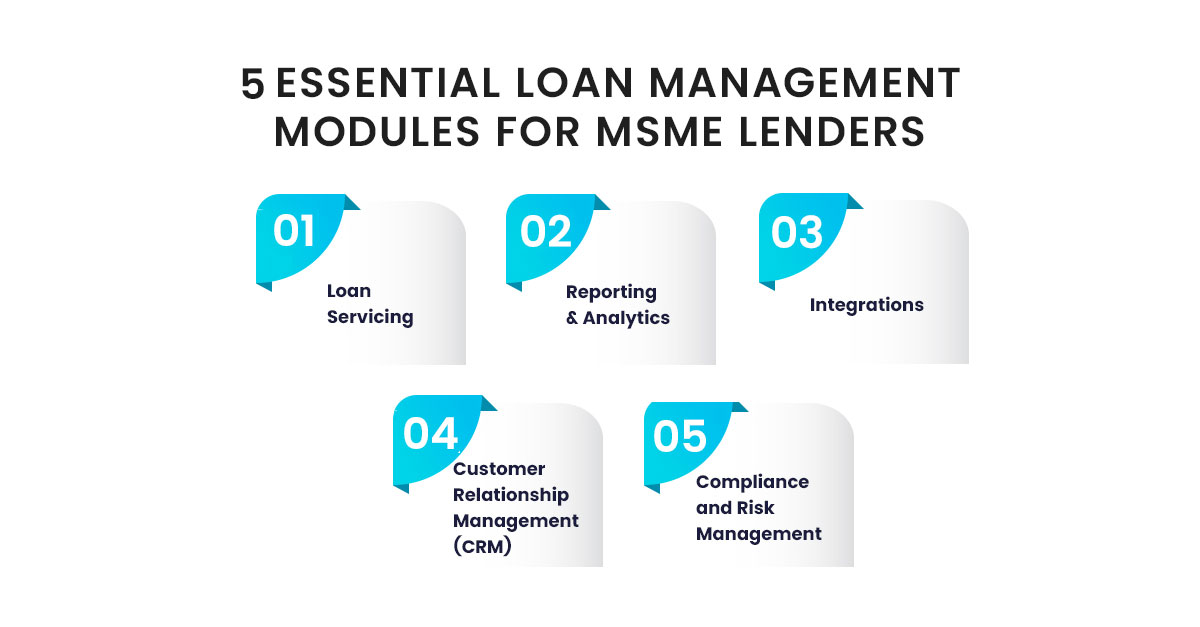

Essential Loan Management modules for MSME Lenders

A robust Loan Management System consists of the following modules:

- Loan Servicing manages the entire loan lifecycle, automates payment collections and reminders to reduce late payments and improves cash flow. It also handles account maintenance tasks such as loan modifications, prepayments and delinquencies.

- Reporting and Analytics offers dashboards and detailed reports on loan performance, portfolio health and risk exposure. These insights help you make data-driven decisions and ensure compliance with regulations.

- Integrations connects with third-party services such as credit bureaus and payment gateways, keeping data up-to-date and synchronized.

- Customer Relationship Management (CRM) helps you engage better with borrowers by tracking interactions and providing personalized communication to strengthen relationships.

- Compliance and Risk Management ensures adherence to MSME regulatory requirements, monitors loan portfolios for potential risks and provides audit trails and documentation for inspections.

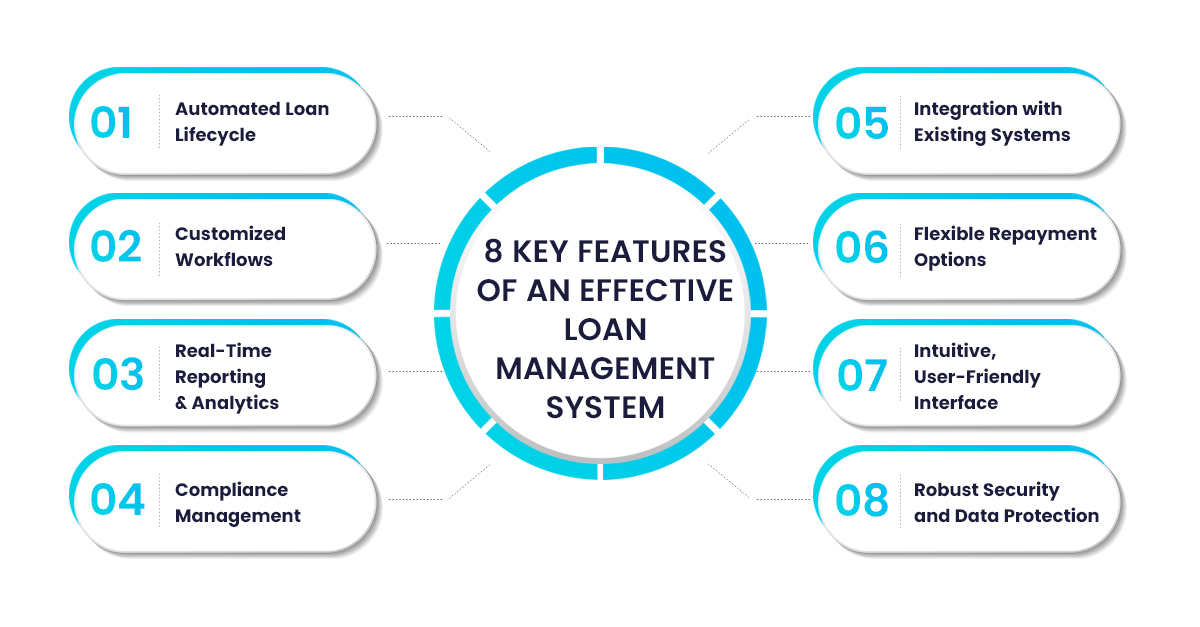

Key Features of an Effective Loan Management System

Choosing the right fit Loan Management System is essential for improving your lending processes and offering a superior customer experience. Here are some key features to consider:

- Automated Loan Lifecycle right from loan application, approval and disbursement to repayment and collections. By reducing manual tasks, you can improve efficiency, minimize delays and handle loans with greater accuracy. Automation also helps better manage workflows, freeing up your team to focus on more strategic tasks like customer service and business growth.

- Customized Workflows for your unique lending needs. Whether it is setting approval hierarchiesadjusting workflows for regulatory guidelines, a flexible LMS should align with your specific business processes.

- Real-Time Reporting & Analytics for deeper insights into your loan portfolio. Access real-time data on borrower behaviour, loan performance and delinquency trends to make informed decisions and mitigate risks. Comprehensive dashboards, automated reports and analytics allow you to track KPIs and optimize your lending strategy for better outcomes.

- Compliance Management to remain compliant with industry regulations by automating audit trails and up-to-date reports. Address complex legal frameworks, reducing the risk of penalties and ensuring that all loans are managed in accordance with regulations.

- Integration with Existing Systems such as Loan Origination Systems (LOS), Customer Relationship Management (CRM) systems, accounting platforms and so on. This eliminates redundant data entry, improves data correctness and streamlines your operations.

- Flexible Repayment Options allowing lenders to configure custom repayment plans based on borrower profiles, including instalment options, grace periods and automated payment reminders. Such options help you reduce delinquency and improve borrower satisfaction.

- Intuitive, user-friendly Interface helps your team to quickly manage loans without extensive training. A clean, efficient design also ensures that borrowers can easily interact with the platform for loan updates, document uploads and repayment tracking. A good user experience allows faster adoption and greater operational efficiency.

- Robust Security and Data Protection features such as encryption, multi-factor authentication and secure access control protect your data. Additionally, the system must comply with global and local data protection laws, ensuring that both lenders and borrowers are protected from data breaches, fraud and other cyber risks.

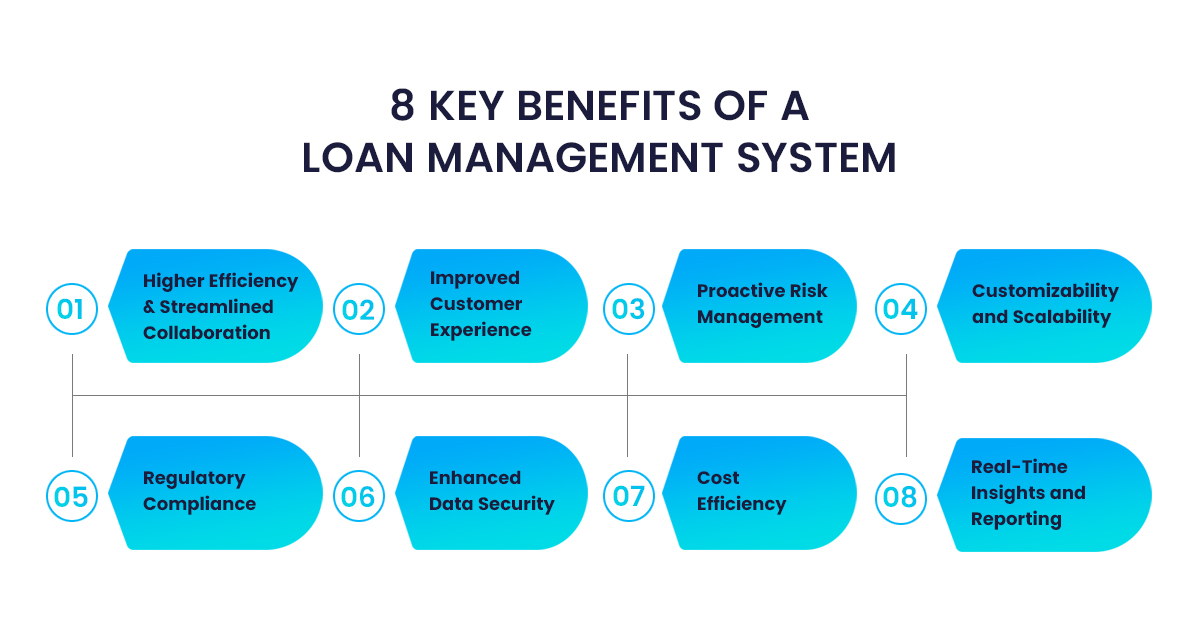

Benefits of a Loan Management System

- Higher Efficiency and Streamlined Collaboration: By automating, payment tracking, and collections, you can significantly reduce processing times and human errors while handling more loans without increasing resources. Additionally, centralized data and workflows enable seamless collaboration between departments such as credit, underwriting, compliance, and customer service. Teams can easily access necessary information, track loan statuses, and communicate effectively, minimizing the need for repeated follow-ups.

- Improved Customer Experience for borrowers through self-serve portals, real-time loan tracking and automated reminders for payments or document submission. This creates a frictionless experience that boosts customer satisfaction and retention.

- Proactive Risk Management because of comprehensive data analytics and real-time insights into loan performance, credit risk and borrower behaviour. With better risk assessment tools, you can implement proactive risk mitigation strategies like adjusting loan terms, renegotiating repayment schedules or increasing borrower scrutiny. Real-time loan monitoring also helps you detect and address issues before they escalate, reducing default rates and financial losses.

- Customizability and Scalability according to your business needs. Whether you are handling new loan products or increasing volumes, the system adapts without requiring a major overhaul.

- Regulatory Compliance by automating regulatory reporting, audit trails and documentation requirements. This reduces the risk of non-compliance and associated penalties.

- Enhanced Data Security with features like advanced encryption, secure access controls and multi-factor authentication to protect your data. Compliance with data protection laws like GDPR or India’s Personal Data Protection Bill ensures peace of mind. By centralizing data securely in one platform, the LMS minimizes the risk of data loss, fraud or unauthorized access.

- Cost Efficiency by automating processes and reducing manual intervention. You can lower operational costs associated with manual processing, error correction, document management and compliance checks. Additionally, fewer resources are needed to manage loan portfolios, freeing up financial and human capital for more value-driven tasks.

- Real-Time Insights and Reporting help lenders gain instant access to data on loan performance, delinquency rates, borrower behaviour and overall portfolio health. Real-time reporting supports better decision-making and helps you optimize your lending strategy.

CredAcc’s Loan Management System for faster, more profitable MSME lending

Understanding the core modules and benefits of a Loan Management System is crucial to improving your new-age lending operations. With the right LMS like CredAcc, you can optimize your processes, improve customer satisfaction and lead to stronger outcomes for your business over time. By prioritizing digital transformation in your loan management strategy, you can effectively address the changing needs of Indian MSME borrowers, remain competitive and support sustainable growth for your organization.

CredAcc’s Loan Management System does two important things in a single platform – managing multiple existing loan products and allowing easy configuration of new loan products. Additionally, it:

- Minimizes customer queries through pre-built accounting ledgers and data-rich account statements.

- Automates interest calculations reducing the manual work required by borrowers.

- Allows lenders to adapt workflows to different lending products and regulatory requirements with no-code capabilities, eliminating the dependency on IT support.

- Addresses diverse client needs with flexible repayment options, including moratorium periods and debt restructuring, driving growth in the competitive lending landscape.

- Provides real-time loan performance monitoring. This allows you to monitor risk effectively and respond quickly to changing borrower circumstances.

For MSME lenders like you who are aiming to scale operations, reduce costs and offer superior borrower service, CredAcc’s Loan Management System provides a practical and scalable solution that supports business growth and effective financial management.

Book a demo to know more about our LMS.