MSME lending in India is expanding steadily, and so is the need to manage it more efficiently. While most Indian banks and NBFCs are well-positioned to meet this growing demand, achieving scale involves more than just increasing capital; it also requires effective management of resources. It requires connected systems, consistent credit workflows, and the ability to adapt to changing borrower needs.

Many lenders are now turning their attention to the underlying infrastructure. Traditionally, the lending process has been handled through separate systems for onboarding, underwriting, disbursement, and management. This approach may have worked at lower volumes, but as portfolios grow, fragmentation creates avoidable complexity.

That’s where a new wave of fintech solutions is making a difference. Developed by top fintech companies in India, these platforms bring the entire credit lifecycle onto a single, integrated system, transforming how lenders operate and scale.

In this blog, we explore how modern financial technology solutions are helping lenders deliver MSME credit with greater speed, control, and clarity.

Why Unified Lending Platforms Are Becoming Essential

MSME lending is not a single transaction. It’s a series of connected steps that must work in sync. From onboarding and credit evaluation to disbursal and repayment, each stage has its own requirements, timelines, and regulatory considerations. Together, they shape both the borrower experience and portfolio performance.

As lenders scale, managing this complexity through disconnected systems can slow things down and create gaps in visibility. That’s why many Indian fintech companies are focused on building unified platforms that integrate the entire lending process into a single, seamless flow.

These full-stack fintech solutions connect every part of the credit lifecycle through a single interface. They streamline operations, accelerate decision-making, and improve coordination across teams. Some platforms also offer no-code configuration, allowing business users to update workflows, adjust policies, or test credit rules without the delays of custom development. This makes it easier to respond to evolving market conditions while maintaining internal consistency. Rather than overhauling how lenders operate, these platforms enhance existing processes and support faster execution, improved oversight, and scalable growth.

Smarter Loan Origination Systems

Loan origination is more than just the first step in a lending journey; it sets the tone for everything that follows. For lenders navigating India’s fast-growing MSME segment, the ability to onboard efficiently, accurately, and compliantly can make all the difference.

Modern loan origination systems go far beyond basic application intake. They function as configurable engines built to support speed, scale, and clarity from the outset. These platforms provide lenders with the flexibility to design product journeys tailored to different borrower segments, sourcing channels, and credit policies, without relying heavily on tech teams.

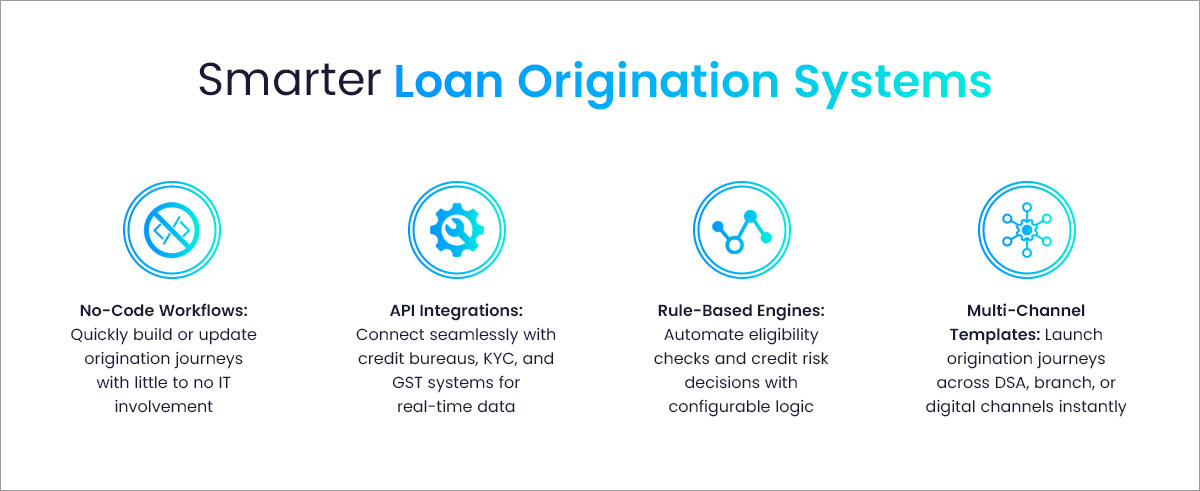

Key capabilities of these financial technology solutions include:

- No-code workflows to create or update origination journeys fast, with minimal IT support

- API integrations with credit bureaus, KYC databases, and GST systems for real-time decision inputs

- Rule-based decision engines to automate eligibility checks and risk assessments

- Ready-to-deploy templates for sourcing via DSA, branch, or digital channels

These fintech solutions reduce manual handoffs, compress approval timelines, and help lenders scale up MSME credit while maintaining strong governance. More importantly, they enable lenders to respond quickly to market shifts such as launching new products, adjusting criteria, and expanding access through a single, agile platform.

As top Indian fintech companies continue to push the boundaries of lending technology, smarter origination systems are emerging as a key driver of growth and a foundation for delivering better credit at scale.

Intelligent Underwriting for MSMEs

Underwriting MSME loans in India requires more than standard financial analysis. Many small businesses lack formal credit histories, show inconsistent cash flows, or follow non-standard documentation practices. In such cases, traditional scorecards often fail to provide a complete picture.

To address this, top fintech companies in India are building underwriting engines that pair automation with adaptability. These next-gen systems are helping lenders move beyond rigid models, offering more nuanced and scalable credit assessments.

Modern fintech solutions in this space integrate both structured and alternative data, making it easier to evaluate borrowers who might have strong cash flows but limited paperwork.

Key capabilities of these financial technology solutions include:

- Customizable scorecards that adjust based on borrower profile, region, or product type

- Automated ingestion of data from financial filings, GST filings, bank statements, and cash flow analytics

- Policy-driven decision engines that ensure consistency while reducing manual involvement

By drawing from a richer dataset and applying rules transparently, these underwriting platforms enable faster decisions without compromising risk management.

For lenders, this means confidently serving a wider range of MSMEs, even in underpenetrated segments. And for borrowers, it means fairer access to credit, based on the realities of how they operate, not just the limitations of legacy credit models.

As Indian fintech companies continue to evolve underwriting tools, the focus is shifting from score-only decisions to context-rich evaluations, unlocking smarter, faster, and more inclusive lending.

Loan Management That Enables Growth

For MSME lenders, managing credit doesn’t end with disbursal. It’s an ongoing process that demands adaptability, control, and operational efficiency. As portfolios grow, so do management complexities: borrowers may need top-ups, renewals, or even restructuring over time. Static systems make these scenarios harder to manage.

Modern loan management systems, developed by top fintech companies in India, are built to handle this operational complexity. These platforms provide lenders with the tools they need to scale efficiently, supporting diverse repayment structures, automating management tasks, and maintaining full visibility into loan performance.

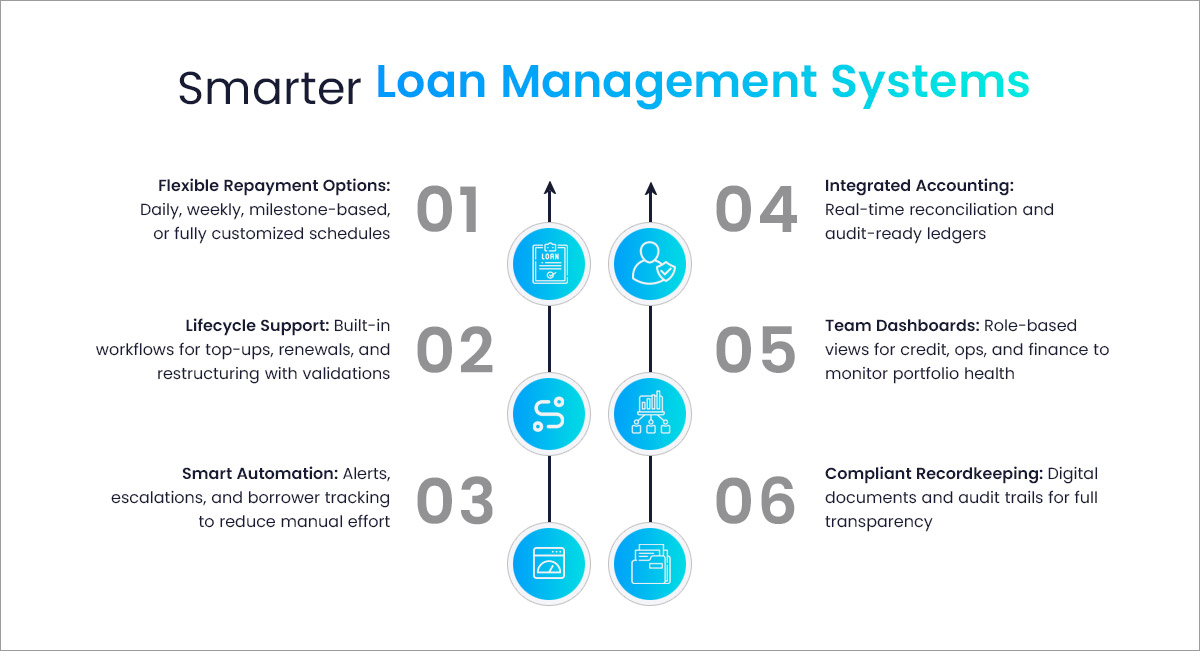

Key capabilities offered by leading financial technology solutions include:

- Flexible repayment structures, including daily, weekly, milestone-linked, or customized schedules

- Support for top-ups, renewals, and restructuring, with built-in workflows and rule-based validations

- Automated management tools, such as alerts, escalations, and borrower status tracking

- Integrated accounting and reconciliation, ensuring ledgers stay accurate and audit-ready

- Role-based dashboards for real-time monitoring across credit, operations, and finance teams

- Digital documentation and audit logs to support compliant, transparent management

These features allow lenders to manage larger books without a proportional increase in effort, strengthen borrower engagement, and reduce operational risk.

No-Code Lending for MSMEs

In MSME lending, two needs run in parallel: the agility to respond to changing borrower profiles and the discipline to maintain consistency across processes. As lending volumes increase, manual interventions become less viable, and automation becomes essential.

This is where modern no-code lending platforms are reshaping credit delivery. These platforms enable lenders to automate entire credit lifecycles without requiring code or custom infrastructure development. Business teams can configure workflows, set rules, and define actions without relying on IT.

The value of no-code lies not just in faster configurations, but in scalable, reusable automation that covers everything from onboarding to management.

Core automation capabilities enabled by these financial technology solutions include:

- Auto-triggered verifications, based on borrower type, loan product, or geography

- Dynamic approval routing, where decisions adjust in real time based on credit score, ticket size, or sourcing channel

- Time-bound actions, such as automated file closures, reminders, or status escalations

- Event-based communication, with email/SMS notifications triggered by milestones like approval, disbursal, or documentation gaps

What sets these fintech solutions apart is their modular design. Workflows created for one product can be replicated, adapted, and versioned for others, enabling lenders to launch and iterate credit journeys faster without reengineering core systems.

By utilizing no-code automation, top Indian fintech companies are helping lenders shift from reactive operations to proactive system design. This approach accelerates time to market, enhances governance, and supports the development of a resilient lending infrastructure that scales with the business.

Benefits of No-Code Platforms for MSME Lenders

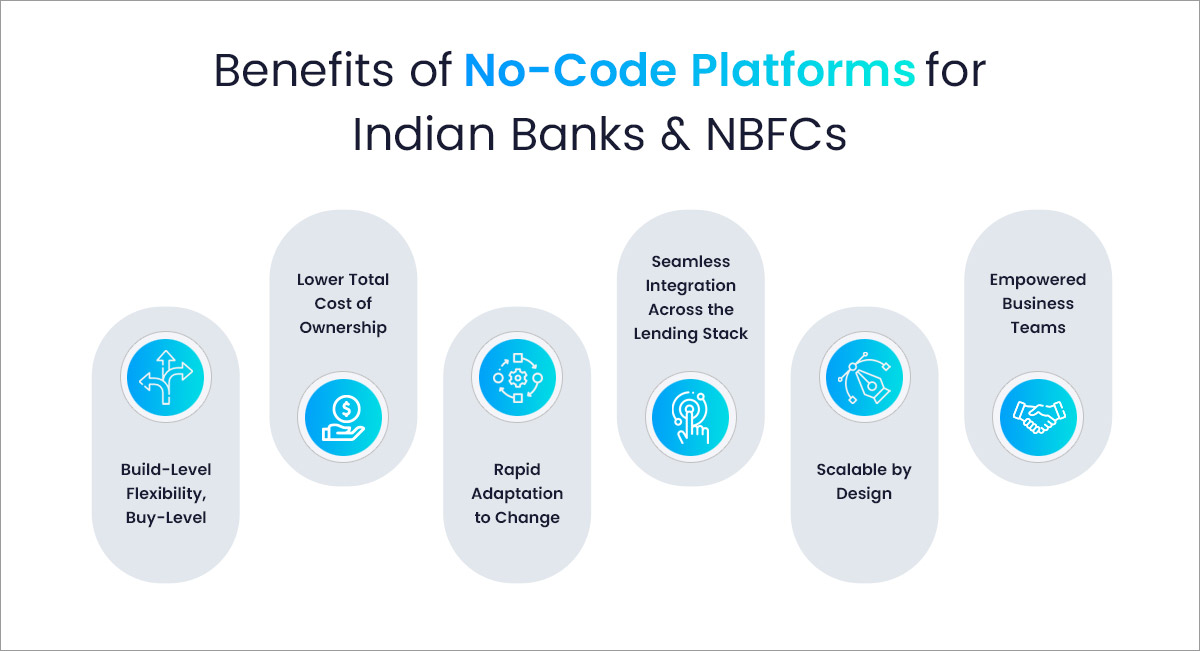

No-code platforms offer the best of both worlds: the flexibility of in-house development and the speed of ready-to-use software. For lenders in India’s rapidly evolving MSME credit space, this balance is becoming increasingly essential.

Used by many top fintech companies in India, no-code frameworks are enabling faster product rollouts, greater operational control, and scalable innovation, without the delays and costs of traditional development cycles.

- Build-Level Flexibility, Buy-Level Speed

No-code platforms enable lenders to design credit journeys, define risk rules, and automate workflows, all without needing to build from scratch. This agility, combined with rapid deployment, makes them ideal for launching and iterating at startup speed while maintaining institutional discipline.

- Lower Total Cost of Ownership

Reducing reliance on large IT teams and long development cycles, no-code tools lower both initial setup and ongoing maintenance costs. Business users can make updates directly, making these platforms a cost-effective core of modern fintech solutions.

- Rapid Adaptation to Change

Regulatory shifts, new partner models, or evolving product needs are all part of MSME lending. No-code platforms support quick updates to policies, rules, and processes, often with version control and full audit logs. It’s why many top Indian fintech companies are standardizing on no-code infrastructure for operational agility.

- Seamless Integration Across the Lending Stack

Modern no-code platforms are built API-first, making integration with credit bureaus, KYC services, GST systems, and existing LOS/LMS infrastructure straightforward. This architecture ensures smooth data flow across the lending value chain, without custom code.

- Scalable by Design

Whether it’s unsecured working capital loans or structured invoice discounting, no-code platforms can support multiple products within the same framework, providing a unified approach. Scalability is key for lenders looking to expand their MSME offerings without reworking their backend systems.

- Empowered Business Teams

With no-code platforms, credit, risk, and operations teams gain direct control over their domains. They can build, test, and deploy workflows independently, while tech teams focus on infrastructure, security, and scale.

Conclusion: Fintech Solutions That Scale With Your Lending Goals

Scaling MSME lending isn’t just about going digital; it’s about building systems that are adaptable, integrated, and purpose-built for the complexities of small business credit. From onboarding and underwriting to disbursal and management, every part of the lending lifecycle needs to work in sync.

When this happens on a unified platform, lenders gain more than efficiency. They gain the ability to respond more quickly, operate with greater clarity, and manage increasing volumes without increasing operational drag.

CredAcc’s Loan Origination System enables no-code product configuration, multi-channel sourcing, and automated decisioning powered by policy-driven rules and API-based data integrations. The Loan Management System supports dynamic repayment structures, automates renewals and top-ups, enables restructuring, and ensures that both management and reconciliation are accurate and scalable.

Both platforms are modular, API-first, and built to integrate easily with your existing architecture. Whether you’re a bank or an NBFC expanding MSME credit or modernizing legacy operations, CredAcc gives you the infrastructure to do it efficiently, intelligently, and at scale.

Book a demo to explore how CredAcc can support your lending strategy.