Lending Management Software: Simplifying MSME Loan Management for Indian Banks & NBFCs

Managing MSME loans post-disbursal is a complex and resource-intensive task for Indian Banks and NBFCs. As loan volumes grow and regulatory requirements become more stringent, traditional manual processes for tracking repayments, managing overdue accounts, and ensuring compliance are no longer sufficient. These outdated systems often lead to inefficiencies, increased risks, and a subpar borrower experience.

Lending Management Software (LMS) is designed to address these challenges by automating the entire post-disbursal loan lifecycle. It centralizes loan data, enabling real-time tracking of loan performance, automated repayment management, and seamless borrower communication. This ensures that both lenders and borrowers stay aligned throughout the loan term.

In this blog, we’ll explore how Lending Management Software enhances operational efficiency, mitigates risks, and ensures compliance in MSME loan management. We’ll also discuss how LMS transforms manual workflows, helping lenders streamline operations and improve overall loan servicing.

Key Challenges in MSME Loan Management for Indian Banks & NBFCs

- Manual and Error-Prone Processes: Traditional loan management systems rely on manual data entry and tracking, increasing the likelihood of errors. From loan repayments to financial reporting, manual processes are slow and error-prone, leading to missed payments, delayed approvals, and inaccurate records.

- Fluctuating Cash Flow of MSMEs: Many MSMEs operate in industries with unpredictable cash flows, making it difficult to adhere to fixed loan repayment schedules. This misalignment can lead to delayed payments and defaults, increasing risk for lenders. Fixed repayment plans often don’t match the financial realities of MSME borrowers.

- Regulatory Compliance: Managing MSME loans requires constant oversight to ensure all policies and procedures are followed, including documentation, interest rates, and loan limits. Manual processes or outdated systems struggle to track regulatory changes and ensure compliance, which can expose lenders to fines, audits, and reputational damage.

- Lack of Transparency in Loan Tracking: In traditional systems, loan information is often fragmented, making it challenging to track loan status, outstanding balances, and repayments in real-time. This lack of transparency increases the risk of missed collections, late payments, and poor cash flow management.

- Risk Management and Default Prevention: Without the right data analytics tools, predicting payment defaults or identifying potential issues in loan performance is difficult. Lenders often lack real-time insights to assess loan health, leading to higher default rates and financial risk.

- Data Security: Handling sensitive borrower data requires strong cybersecurity measures to prevent breaches.

What is Lending Management Software?

Lending Management Software automates and streamlines the post-loan disbursal process for lenders, handling essential tasks such as tracking repayments, managing overdue loans, monitoring performance, and ensuring regulatory compliance.

By centralizing loan-related data, LMS provides lenders with a unified platform to manage multiple loans efficiently. It automates routine tasks, including payment reminders, interest calculations, and loan balance updates, reducing manual effort and increasing speed, accuracy, and reliability. It also improves transparency by giving lenders and borrowers real-time access to loan details, ensuring clear communication.

How Lending Management Software Simplifies MSME Loan Management

LMS simplifies the management of MSME loans by automating core processes and allowing lenders to manage fluctuating cash flows and customize repayment schedules. Once a loan is disbursed, LMS ensures efficient loan servicing through:

- Automated Loan Tracking of repayments, balances, and overdue amounts, reducing the administrative burden on lenders.

- Customizable Repayment Terms based on MSME borrowers’ financial situations, ensuring payments align with their cash flow.

- Proactive Risk Management with real-time insights into loan performance using predictive analytics to identify risks, enabling early intervention.

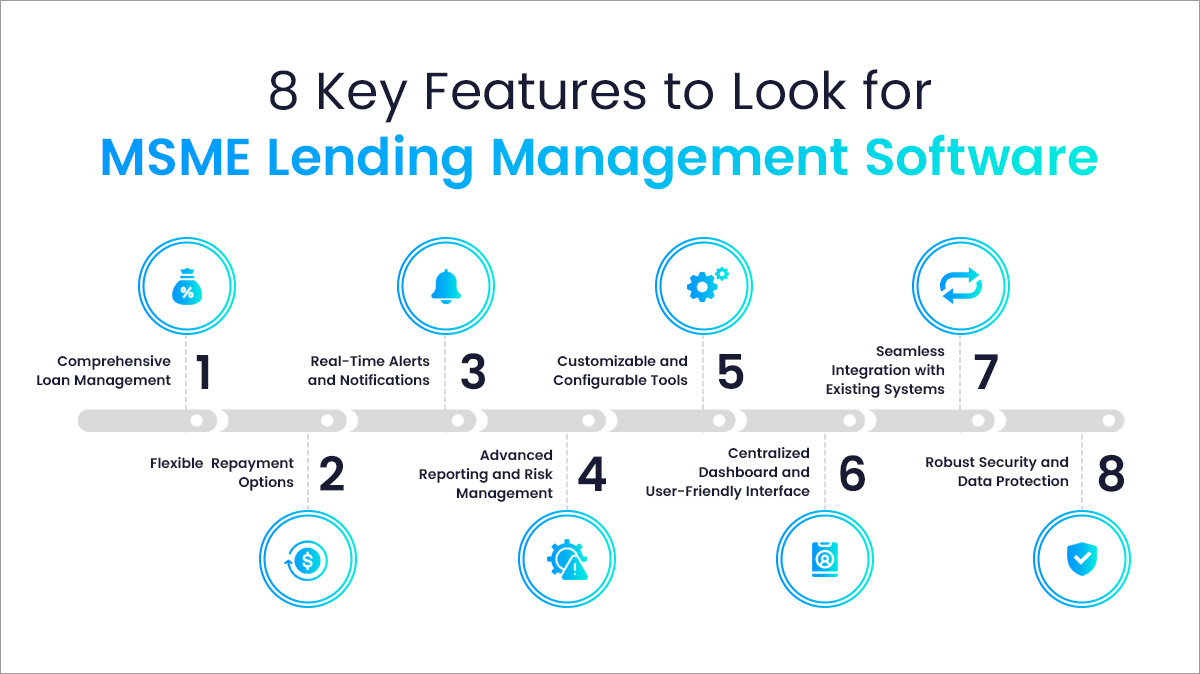

Key Features to Look for in Modern Lending Management Software

- Comprehensive Loan Management: An LMS must track loan balances, repayment schedules, and outstanding amounts in real-time, eliminating manual errors. It should automate interest calculations and update loan balances instantly to ensure precise financial management.

- Flexible Repayment Options: Given the fluctuating cash flows of MSMEs, an LMS must provide customizable repayment schedules. This flexibility allows lenders to tailor repayment terms based on the borrower’s financial situation, such as offering moratorium periods or debt restructuring options.

- Real-Time Alerts and Notifications: The LMS should send timely alerts to borrowers about upcoming repayments, overdue payments, or loan term changes. This ensures that both lenders and borrowers stay informed and proactive in managing loan obligations.

- Advanced Reporting and Risk Management: The LMS should offer detailed, automated reporting and real-time monitoring of loan performance. It must provide lenders with clear insights into loan status and borrower-specific data, featuring early warning systems and predictive analytics to identify potential risks.

- Customizable and Configurable Tools: A next-gen LMS must include configurable rule engines for loan monitoring, collateral management, interest structures, and recovery policies. It should support tailored settlement management with flexible payment frequencies and tranche settlements to meet the diverse needs of MSME borrowers.

- Centralized Dashboard and User-Friendly Interface: The LMS should offer a centralized dashboard that provides real-time visibility into the loan portfolio. Lenders must be able to manage loans effectively with up-to-date loan status information in one place. The interface should be intuitive and easy to navigate, ensuring both lenders and borrowers can easily track repayments, receive loan updates, and upload documents.

- Seamless Integration with Existing Systems: The LMS must integrate smoothly with existing systems such as Loan Origination Systems (LOS), Customer Relationship Management (CRM) tools, and accounting software. This integration reduces redundant data entry, improves accuracy, and streamlines workflows across departments, from loan approval to servicing and collection.

- Robust Security and Data Protection: The LMS should incorporate advanced encryption, multi-factor authentication, and controlled access to protect sensitive borrower and loan data. Additionally, it must adhere to global and local regulatory standards to ensure compliance with privacy and data protection laws, mitigating the risk of fraud and breaches.

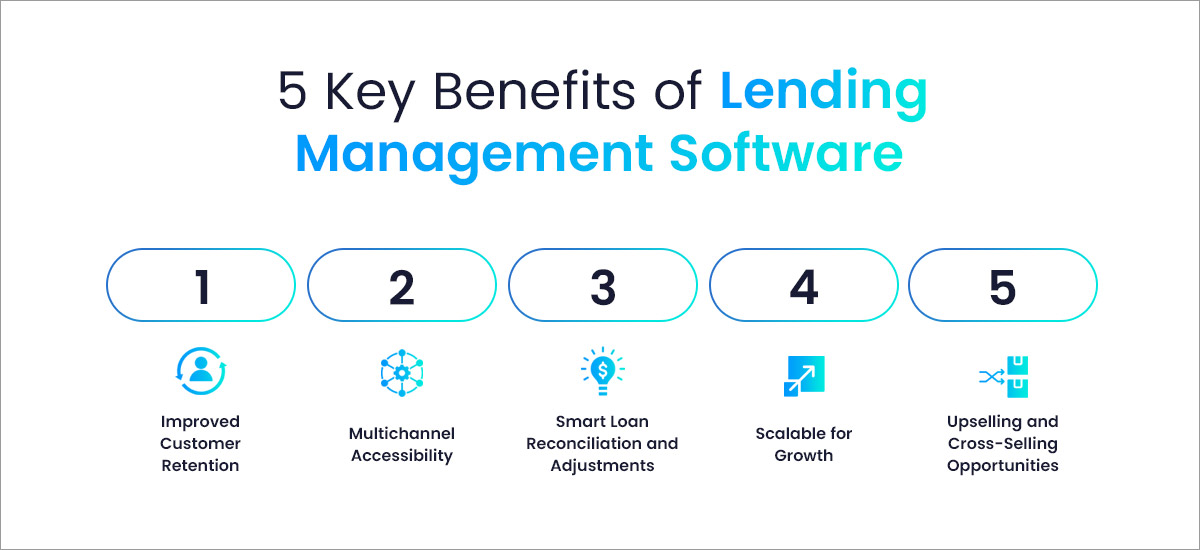

Key Benefits of Lending Management Software

- Improved Customer Retention: The flexibility and transparency provided by an LMS significantly enhance the borrower experience. With automated payment reminders, flexible repayment terms, and real-time tracking, borrowers are more likely to stay on top of their loans, improving satisfaction and long-term loyalty.

- Multichannel Accessibility: A next-gen LMS provides a consistent, user-friendly experience across multiple platforms, including mobile, web, and portals for agents and borrowers. This ensures that borrowers can easily access their loan information and make payments from any device.

- Smart Loan Reconciliation and Adjustments: Modern LMS platforms come equipped with intelligent loan reconciliation tools, enabling lenders to track loan performance across multiple products. These tools help ensure high portfolio efficiency, allowing for accurate reporting and data-driven decision-making.

- Scalable for Growth: As MSME loan portfolios grow, an LMS must scale seamlessly without compromising performance. A next-gen LMS can handle an increasing volume of loans, adapting to new loan products, regulatory changes, or business expansion needs, ensuring lenders can continue to operate efficiently as they scale.

- Upselling and Cross-Selling Opportunities: With advanced customer segmentation and analytics, LMS enables lenders to identify new business opportunities. By analyzing borrower behavior, lenders can offer personalized loan products or services, driving revenue growth through cross-selling and upselling.

Conclusion: Implementing Lending Management Software for Smarter MSME Loan Management

Adopting modern Lending Management Software (LMS) provides Indian Banks and NBFCs with a significant competitive edge in managing MSME loans. Investing in LMS streamlines operations and helps lenders stay ahead of regulatory changes and customer expectations, fostering sustainable growth.

CredAcc’s LMS offers advanced API-first configurability and robust automation, enabling banks and NBFCs to exceed functionality expectations, optimize operations, and achieve quicker ROI. The system automates disbursements, calculations, and notifications while handling overdue loans and collections. Its flexible configurability and compliance support ensure smooth repayment processes and minimize defaults, ultimately improving portfolio performance. With powerful analytics, adjustable automation levels, and comprehensive reporting tools, CredAcc empowers lenders to optimize resources and strengthen business operations.

Book a demo to see how CredAcc’s Lending Management Software can transform your MSME loan operations.