Why It’s Taking Weeks to Launch a New Supply Chain Finance Product (and How to Cut It Down to Days)

Launching a new supply chain finance product in India should be a straightforward way for banks and NBFCs to support corporates, suppliers, and distributors with timely access to working capital. Yet in reality, it often takes weeks, sometimes months, before a new supply chain finance solution is ready to go live. During this time, businesses wait for liquidity, suppliers wait for payments, and competitors with faster rollouts gain an edge.

The demand is clear. India’s supply chains are vast and increasingly digital, and lenders recognize that supply chain finance platforms can strengthen relationships, expand credit portfolios, and open new revenue streams. The challenge lies in the complexity of launching such offerings – multiple stakeholders, compliance requirements, legacy system integrations, and manual workflows all slow down time-to-market.

This article covers why introducing supply chain finance in India still takes weeks, what the hidden costs of these delays are, and how lenders, especially banks & NBFCs offering supply chain finance in India, can cut launch timelines down to days. By breaking down the traditional process, identifying bottlenecks, and highlighting digital approaches already gaining traction, we’ll show how institutions can roll out SCF faster, more efficiently, and with stronger governance.

What is Supply Chain Finance?

Supply chain finance (SCF) refers to a set of financing solutions that improve liquidity across the value chain by aligning the working capital needs of buyers, suppliers, and intermediaries. At its core, SCF allows buyers, often large corporates, to extend payment terms without disrupting supplier cash flows. Suppliers, in turn, can access early payment at a discount, facilitated by a bank or NBFC providing supply chain finance in India.

The model creates a win–win. Buyers get more time to manage payables, while suppliers receive faster access to funds, improving their cash cycles. For lenders, it opens up opportunities to grow quality assets, strengthen client relationships, and offer differentiated products in a competitive market.

A typical supply chain finance platform connects three key stakeholders:

- Buyers (corporates): who anchor the program and negotiate payment terms.

- Suppliers and distributors: who benefit from early payment options.

- Financial institutions (banks and NBFCs): who fund the transactions and manage credit risk.

The scope of SCF has expanded well beyond simple invoice discounting. Today, lenders deploy a variety of supply chain finance solutions, including factoring, distributor and dealer financing, purchase invoice discounting, and even deep-tier financing that reaches smaller suppliers.

In India, where supply chains are fragmented and liquidity gaps are common, SCF is increasingly seen as a strategic product line, one that enhances competitiveness while reducing systemic risk.

Why Launching Supply Chain Finance Products is So Slow

For many banks and NBFCs in India, launching a new supply chain finance solution is rarely quick. What should take days often stretches into weeks because of challenges that are both operational and specific to the Indian context:

- Anchor-Led Program Design

SCF in India revolves around anchor corporates who verify invoices, influence repayment behavior, and often drive onboarding. Each anchor brings its own hierarchies, data formats, and approval flows—difficult for legacy systems to adapt to quickly. - Borrowers Across Tiers and Formats

Programs typically include vendors, distributors, dealers, and even sub-dealers. Each group varies in documentation standards, credit readiness, and transaction flows. Designing a one-size-fits-all workflow creates delays and risks. - Invoice-Linked Lending with Dynamic Limits

Credit lines in SCF shift continuously based on live receivables, anchor approvals, and transaction history. Without systems that can ingest GST/ERP data and recalculate drawing power automatically, manual intervention slows down rollout. - Non-Standard Repayment Structures

Repayments are often milestone-based, buyer-triggered, or partial—especially in vendor and project financing. Traditional LMS setups tied to fixed EMI schedules are poorly suited for this, leading to rework and delays. - High-Frequency, Low-Ticket Volumes

Thousands of invoices worth ₹50,000–₹5,00,000 must be underwritten, booked, and tracked. Manual handling isn’t scalable or compliant, yet many lenders still rely on it. - Fragmented Technology

Legacy core banking systems are not built for modern supply chain finance platforms. Adding modules for onboarding, underwriting, and disbursement requires IT customization, vendor coordination, and lengthy testing cycles. - Cumbersome Compliance and Reporting

Programs depend on GST validation, KYB/KYC, and RBI-mandated exposure reporting. Manual checks across multiple teams drag out activation and add audit risk. - Governance and Risk Layers

Lenders must meet strict fraud prevention and audit standards. Without automation, each approval layer and document review extends timelines further.

The combined effect of these hurdles is clear: lenders miss opportunities where corporates expect faster rollouts and suppliers need quick access to working capital.

Traditional SCF Product Launch Process (Step-by-Step)

Launching a new supply chain finance product in India usually follows a standard sequence. Each step is necessary, but when paired with the structural and regulatory complexities of SCF, the process stretches from days into weeks:

- Market Assessment and Anchor Identification

- What happens: Lenders evaluate demand, identify anchor corporates, and design the scope of the program.

- Where delays occur: Each anchor has unique workflows, invoice formats, and hierarchies that must be mapped—slowing internal alignment and approvals.

- Product Design and Policy Setup

- What happens: Credit policies, risk parameters, DP rules, and repayment structures are defined.

- Where delays occur: Policies must accommodate diverse borrower tiers (vendors, distributors, sub-dealers) and non-standard repayment models such as milestone-based or buyer-triggered settlements. Designing for this variability requires cross-team coordination and multiple iterations.

- Technology and System Integration

- What happens: Core systems are integrated with SCF modules, portals, GST/ERP data sources, and APIs.

- Where delays occur: Legacy infrastructure is rarely designed for invoice-linked lending with dynamic limits. Building and testing these integrations is resource-heavy and time-consuming.

- Compliance and KYC/KYB Validation

- What happens: GST data, financial statements, and corporate documents are verified; exposure limits and reporting obligations under RBI norms are checked.

- Where delays occur: Manual compliance processes across multiple teams slow credit line activation and increase the chance of rework.

- Pilot and Limited Rollout

- What happens: A small supplier or distributor set is onboarded to test workflows.

- Where delays occur: High-frequency, low-ticket invoice flows expose gaps in scalability. Feedback cycles, manual reconciliation, and adjustments further extend timelines.

- Full-Scale Deployment

- What happens: The program is rolled out to the wider supplier base.

- Where delays occur: Without automation, onboarding thousands of participants and reconciling event-driven repayments becomes operationally intensive and slow.

The Real Costs of Delayed Launches

Every additional week it takes to launch a new supply chain finance solution translates into lost opportunities. Corporates looking for immediate liquidity may shift to competitors or fintech-led supply chain finance platforms that can deploy faster. This weakens the lender’s ability to position itself as a preferred partner.

Delays also mean suppliers and distributors wait longer for working capital, straining relationships and reducing trust in the lender’s ability to deliver. For banks and NBFCs in India, this can result in reduced supplier participation rates and slower portfolio growth.

Operational costs rise as well. When manual processes drag out product setup, resources are consumed by repeated compliance checks, IT workarounds, and re-approvals. This raises the cost of launching and managing programs, making smaller ticket sizes even less profitable.

Perhaps most critically, delayed launches erode market relevance. In a competitive landscape where corporates demand speed and flexibility, being weeks late to market often means losing deals that could have built long-term credit relationships.

How to Cut Launch Timelines From Weeks to Days

The delays caused due to traditional supply chain finance product launches in India are not inevitable. By combining no-code technology with digital platforms, agile working models, and pre-built modules, banks and NBFCs in India can bring new supply chain finance solutions to market in days—without losing control over compliance or risk. These platforms don’t simplify SCF, they make it possible to design and manage its complexity at scale.

- Embracing Digital Platforms and Automation

Modern supply chain finance platforms, especially those built on no-code architecture allow lenders to configure programs quickly while managing the complexity of anchor-driven finance. These systems replace months of coding with drag-and-drop workflows for onboarding, credit rules, decisioning, and disbursement.

Automation is the key accelerator. Examples include:

- Digitized KYC/KYB journeys with GST and bank statement validation.

- Automated rule engines for invoice discounting, DP recalculation, and credit scoring.

- Digital document generation and e-signing for sanction letters and loan agreements.

- Event-driven alerts for renewals, expiries, or utilization breaches.

Together, these tools eliminate manual rework, reduce errors, and compress turnaround times from weeks to hours.

- Cross-Functional Agile Teams

Technology delivers speed only when paired with agile execution. Successful lenders build cross-functional teams that bring together compliance, credit, product, tech, and anchor success functions. Instead of handing off tasks sequentially, these teams run short, iterative cycles:

- Product and credit define anchor-wise rules.

- Compliance maps regulatory checks into configurable workflows.

- Tech integrates APIs and ensures data security.

- Business teams pilot with a small supplier set, refining workflows weekly.

Because no-code platforms don’t require developer intervention for every change, these teams can adapt eligibility criteria, approval hierarchies, or invoice-verification steps in real time, accelerating time-to-market while maintaining governance.

- Leveraging Pre-Built SCF Modules & APIs

Reinventing core workflows slows launches. Instead, lenders can tap into pre-built SCF modules and APIs covering:

- Onboarding: digital document collection, GSTN validation, KYB.

- Underwriting: configurable scorecards, anchor-wise decision rules, automated risk checks.

- Invoice management: ERP uploads, anchor portals, or GST feeds validated with rule-based checks.

- Loan management: dynamic credit line tracking, milestone-linked repayment, partial settlements.

Pre-built APIs for GST, bureaus, and banking data ensure real-time data flow, while role-based portals give suppliers, anchors, and underwriters tailored access. This approach enables lenders to deploy multiple supply chain finance products, such as factoring, distributor finance, supplier & vendor finance, and sales & purchase invoice discounting without lengthy custom development.

- Governance and Auditability

Speed does not mean compromising compliance. No-code platforms provide version-controlled audit trails, logging every workflow, rule, and action. Regulators and internal teams get full visibility into how decisions are made, ensuring programs remain both fast and audit-ready.

What This Looks Like in Practice

- Configure anchor-specific workflows on the no-code platform.

- Plug in GST, bureau, and banking APIs.

- Pilot with a limited supplier cohort using role-based portals.

- Iterate on credit rules and workflows weekly.

- Scale to full deployment once performance stabilizes.

By blending no-code configurability, digital automation, agile teams, and pre-built modules, lenders can reduce rollout timelines dramatically – turning multi-week dependencies into parallel tasks and delivering new supply chain finance platforms in India at speed, without losing governance or control.

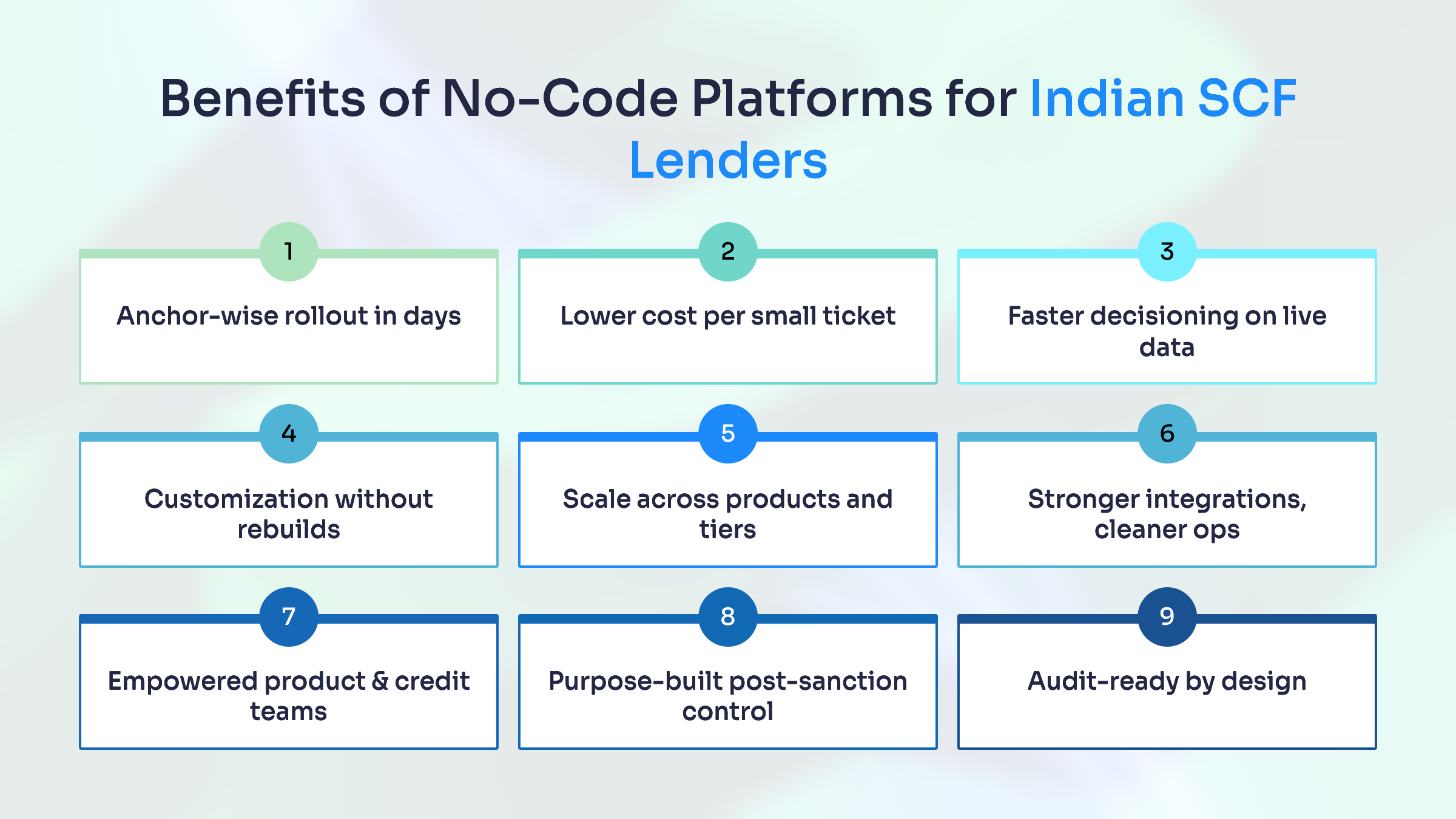

Benefits of No-Code Platforms for Indian SCF Lenders

For banks and NBFCs offering supply chain finance in India, the pressure is twofold: launch programs quickly and manage them reliably at scale. Traditional systems rarely deliver both. This is where no-code technology makes a real difference. By combining configurability, automation, and integration, no-code platforms give lenders the speed to roll out new programs in days and the control to keep governance intact.

The advantages go beyond faster launches. No-code systems reshape how supply chain finance platforms operate across the product lifecycle—from onboarding and underwriting to loan management and compliance. Here are the key benefits that make them particularly well-suited for supply chain finance solutions in India:

- Anchor-wise rollout in days

Configure buyer/anchor–specific onboarding, verifications, and approval paths without code, so new supply chain finance programs go live quickly and stay aligned to each anchor’s workflows. - Lower cost per small ticket

Automate GST/KYB checks, underwriting, and booking to reduce manual effort, making high-frequency, low-ticket supply chain finance solutions economically viable at scale. - Faster decisioning on live data

Use pre-integrated APIs (GST, banking, bureaus) and rule engines for DP recalculation and invoice-linked credit so credit lines move from request to sanction in hours—not days. - Customization without rebuilds

Tailor journeys for vendors, dealers, distributors, and deep-tier suppliers—fields, validations, and decision rules—through configuration, not projects. - Scale across products and tiers

Launch and manage factoring, distributor finance, purchase invoice discounting, deep-tier finance, and more on one supply chain finance platform, without major rework as volumes rise. - Stronger integrations, cleaner ops

Plug into GSTN/ERP uploads, anchor portals, core banking, and payments via APIs to keep data flowing and reconciled across the SCF lifecycle. - Empowered product & credit teams

Let non-technical teams adjust eligibility, scoring, limits, and approval hierarchies safely—speeding iteration while reducing dependency on IT queues. - Purpose-built post-sanction control

Manage event-driven repayments (milestone-linked, buyer-triggered, partial settlements), renewals, and real-time reconciliation in an SCF-specific LMS. - Audit-ready by design

Versioned configurations and end-to-end audit trails give compliance full visibility into who changed what and when—supporting rapid launches with governance intact.

Conclusion

Launching a new supply chain finance product doesn’t have to be a long, sequential build. With the right platform, banks and NBFCs can configure anchor-wise workflows, digitize onboarding and compliance, and manage dynamic credit lines without extended development cycles.

CredAcc offers this approach in one stack: a no-code supply chain finance platform with configurable journeys and rules, pre-integrated APIs for GST/banking/bureaus, role-based portals for anchors, suppliers, and underwriters, and versioned audit trails for governance. Its SCF-specific LMS supports event-driven repayments, partial settlements, renewals, and real-time loan management, important for supply chain finance in India where EMI-style schedules rarely apply.

If you’re evaluating ways to reduce time-to-launch from weeks to days, while keeping control over policy and compliance, CredAcc can help you operationalize the methods outlined in this article.

Book a demo to explore how CredAcc can support your next SCF launch.

Frequently Asked Questions

What is supply chain finance in India?

Supply chain finance is a set of solutions that let corporates extend payment terms while enabling suppliers and distributors to access early payments. Banks and NBFCs offering supply chain finance in India provide liquidity against invoices, strengthening cash flow across the value chain.

Why do SCF product launches usually take weeks?

Delays arise from legacy systems, manual KYB/KYC, and anchor-specific program requirements. Each new corporate or borrower segment often demands fresh coding, multiple compliance checks, and workflow reconfiguration—stretching timelines.

How does a no-code supply chain finance platform accelerate launches?

No-code platforms allow product teams to configure onboarding journeys, decision rules, and repayment logic without writing code. This flexibility cuts rollout timelines from weeks to days while keeping compliance and audit trails intact.

Can these platforms manage India-specific compliance needs?

Yes. Modern SCF platforms integrate directly with GSTN, bureau, and banking APIs, automate document checks, and maintain versioned audit logs. This ensures programs are both faster and audit-ready.

What types of SCF solutions can lenders deploy digitally?

Factoring, distributor and dealer finance, purchase invoice discounting, deep-tier supplier finance, and sales invoice financing—all supported through configurable workflows and anchor-wise rules.