Supply Chain Finance Technology: Simplifying MSME Lending for Indian Banks & NBFCs

Supply chain finance has long served as a vital mechanism supporting MSMEs, yet it is the underlying technology that is truly transforming the lending landscape. As banks and NBFCs embrace innovative solutions to streamline their operations, supply chain finance technology is simplifying the entire lending lifecycle. This technological shift enables lenders to offer financial solutions that are specifically tailored to the unique needs of supply chains, ensuring timely financing while mitigating risk exposure.

At its core, supply chain finance technology automates the entire lending process, from loan origination to repayment management, making the process faster, more efficient and more adaptable to the needs of MSME borrowers. By integrating advanced digital platforms, banks and NBFCs can track real-time data, conduct better risk assessments and disburse loans specifically designed to match a business’s cash flow cycles.

In this blog, we will explore how SCF technology is reshaping the way Indian lenders approach supply chain finance lending. Additionally, we will learn about how it helps banks and NBFCs overcome the traditional challenges in supply chain finance lending, improving operational efficiency, enhancing risk management, and providing personalized business solutions.

Key Borrowing Challenges for MSMEs in Supply Chain Finance

MSMEs often face several challenges when securing supply chain finance, which can hinder their growth potential, such as:

- Limited Credit History: Many MSMEs have a limited credit history, making it difficult for lenders to assess their creditworthiness. Without sufficient data, traditional financial institutions hesitate to approve loans, leading to higher rejection rates or less favourable terms.

- Lack of Collateral: Collateral requirement is a significant barrier for MSMEs. Many businesses do not have the physical assets needed to secure loans, leaving them with limited access to financing options. This can restrict their ability to obtain the much-needed capital for growth.

- Complex and Lengthy Application Processes: Traditional lending processes are often slow and complicated, requiring extensive paperwork and multiple rounds of approval. MSMEs, which usually operate with limited administrative resources, find it challenging to navigate these complex procedures, leading to delays in obtaining financing.

- High Interest Rates: While traditional lenders decline financing, MSMEs often turn to alternative lenders who charge exorbitantly high interest rates. These high rates can quickly become unmanageable, adding financial strain on the business and stifling growth.

How Supply Chain Finance Technology Addresses MSME Borrowing Challenges

Supply chain finance technology is transforming MSMEs financing by addressing the above challenges. Through automation and data-driven solutions, SCF technology enables banks and NBFCs to offer more efficient, flexible and tailored financial support for MSMEs. Here’s how it tackles key challenges:

- Improved Credit Assessment with Alternative Data: Limited credit history can make it difficult for lenders to assess an MSME’s creditworthiness. SCF technology resolves this issue by enabling lenders to use alternative data sources such as transaction history, supplier performance, and payment behaviour to evaluate risks more accurately. This allows lenders to offer financing to MSMEs that might not meet the traditional assessment criteria.

- Enhanced Collateral Management: The absence of physical collateral is a major challenge for many MSMEs. In supply chain finance, lenders can use receivables, purchase orders, and inventory as collateral. SCF technology automates the tracking, verification and real-time monitoring of these assets, enabling lenders to manage collateral without requiring physical assets. This reduces the barriers for MSMEs to financing while helping lenders mitigate risks.

- Streamlined Application and Approval Process: Traditional loan applications involve extensive paperwork and lengthy approval cycles. SCF technology streamlines this process by automating loan origination and approval workflows, so that lenders can provide quicker financing. This reduces administrative delays, allowing MSMEs to seize business opportunities without delay.

- Reduced Cost of Financing: High interest rates can significantly burden MSMEs when borrowing from traditional lenders. By leveraging real-time data for more precise risk assessments, supply chain finance technology allows lenders to offer more competitive and affordable financing terms. This lowers the cost of financing, making it more accessible and manageable for MSMEs.

How Supply Chain Finance Technology Enhances Lender Efficiency

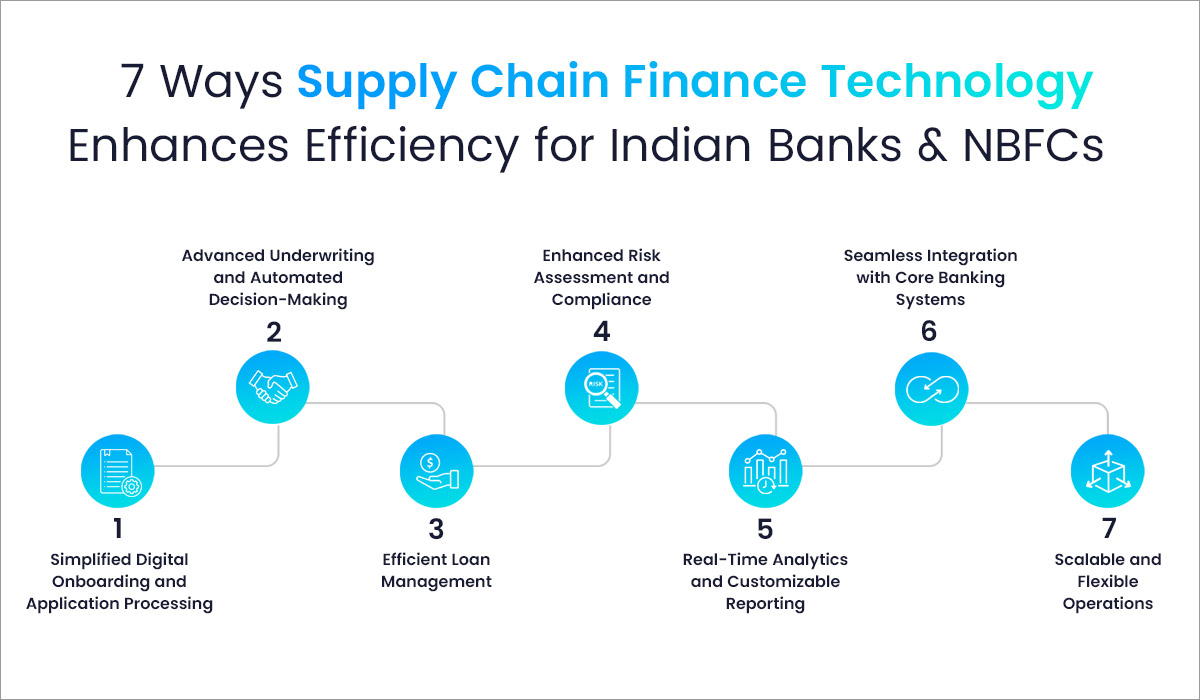

SCF technology not only benefits MSMEs but also positively impacts how lenders operate. By automating key processes and providing real-time insights, it enhances efficiency in multiple areas:

- Simplified Digital Onboarding and Application Processing: SCF technology automates data collection and verification, reducing the need for manual intervention. This speeds up the onboarding and loan approval processes, ensuring a smoother experience for both lenders and borrowers.

- Advanced Underwriting and Automated Decision-Making: By leveraging advanced data analytics, SCF technology allows lenders to assess creditworthiness more accurately. Automated decisioning tools help lenders make faster, informed decisions and offer customized loan terms tailored to specific MSME needs.

- Efficient Loan Management: SCF technology integrates loan management systems that enable lenders to track loan performance, manage disbursements and monitor repayments in real-time. Such automation reduces administrative workload and ensures any potential issues, such as missed payments, are addressed proactively.

- Enhanced Risk Assessment and Compliance: Real-time risk monitoring tools within SCF technology help lenders predict and prevent defaults by using data-driven insights. Automated compliance checks ensure lenders remain aligned with regulatory standards, reducing the risk of non-compliance.

- Real-Time Analytics and Customizable Reporting: The real-time analytics capability of SCF technology allows lenders to gain deeper insights into loan portfolios, borrower behaviour and market trends. Customizable reporting tools help lenders make strategic, data-backed decisions to optimize portfolio performance.

- Seamless Integration with Core Banking Systems: Supply chain finance technology integrates with existing core banking systems, ensuring smooth data flow and operational consistency. This minimizes disruption and makes it easier for lenders to adopt such solutions without overhauling their existing infrastructure.

- Scalable and Flexible Operations: The scalable nature of SCF technology allows lenders to expand their operations without the need for significant new investments. As the business grows, the technology adapts to handle increased volumes, ensuring sustained operational efficiency and service quality.

Embracing the Future of MSME Financing with SCF Technology

The MSME financing ecosystem is rapidly evolving, with SCF technology leading the way. By addressing traditional barriers such as limited credit history, lack of collateral and complex application processes, supply chain finance technology creates new growth opportunities for both lenders and MSMEs. It redefines how businesses access and manage capital, using real-time data, automation and flexible financing options.

By leveraging supply chain finance technology, lenders can now approve loans faster, personalize loan structures and make processes highly transparent, thereby attracting new MSME clients and strengthening their existing relationships. This advanced technology enables lenders to provide more than just financing, it helps them actively contribute to the growth and success of the businesses they support.

CredAcc’s supply chain finance technology helps lenders underwrite accurate credit lines faster than traditional cloud-based lending systems. With its easy-to-use, highly configurable platform and pre-built data integrations, it integrates smoothly with existing legacy software. With its deep expertise in complex supply chain finance products, CredAcc ensures minimal loss rates and optimal performance.

The platform’s no-code Loan Origination System (LOS) and Loan Management System (LMS) provides MSME lenders with a smooth, automated solution that requires no technical expertise. Lenders can quickly adapt to market changes and customize solutions to meet the specific needs of MSMEs. By streamlining loan origination, reducing operational costs and improving risk management, CredAcc’s supply chain finance technology helps lenders provide faster, more transparent approvals, empowering MSMEs to unlock their growth potential.

Book a demo today to discover how our supply chain finance technology can accelerate your growth.