#NextGenCreditDecisioning Part 1

Traditional credit decisioning methods share a significant shortcoming—they are quite rigid, with little room for nuance. Businesses and people are not static or predictable. In order to increase one’s addressable universe of customers and to meet evolving customer needs, banks need to have different credit boxes and associated workflows to address the needs of different segments. i.e. one size cannot fit all.

The state of credit risk management for SMB borrowers today

The United States Census Bureau estimates that in 2020, a record 4.4M new business applications were filed—a 44% increase over the 3.5M applications filed in 2019. This was surpassed in 2021, which saw 5.4M new applications—a 22% increase from 2020 and a stunning 54% increase over 2019.

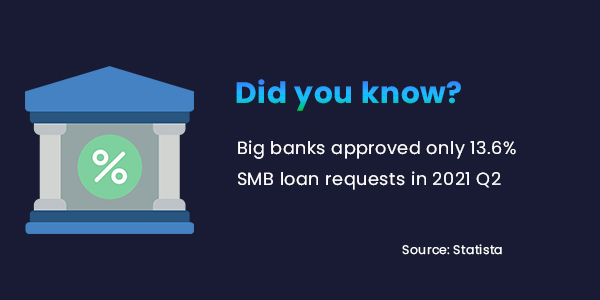

This presents a massive opportunity for financial institutions (FIs) since 85% of these SMBs consider credit the most vital driving factor for their success, yet many are unhappy with the credit decisoning process itelf. In the FED small business credit survey, 33% of respondents reported dissatisfaction with long credit-decision waiting periods, and 28% found the application process difficult. A recent survey by the American Banking Association reveals that more than half of large banks in the US have incorporated digital loan origination channels. Despite the increasing number of businesses and digitization of the loan process, approval rates for business loans have fallen significantly over the last two years. The reason that digitization is not leading to increased opportunities for FIs and small businesses is that most of the digitization is limited to front-end processes—loan applications, customer onboarding, documents, and e-signatures—rather than innovation in credit decision-making. Potential long-term profitable relationships for FIs become missed opportunities, as only 32% of large and 13% of small banks offer automated and instant credit decisions.

SMBs today do not always fit into traditional definitions. For example, an e-commerce business in Texas may have only five employees but might make over $5M in annual revenue.

Traditional credit systems: challenges and limitations

- Burdensome processes due to disparate lending systems and fragmented data

Most large banks have expanded through M&A. In these institutions, systems are often segmented according to business units or geography. Hence, credit decisioning systems miss out on relevant customer data residing in different systems, failing to deliver accurate decisions.

- Longer time-to-market due to inflexible legacy tech

Relying on software development centered around legacy systems hinders innovation, speed, and flexibility in the credit decisioning process. For large banks, building credit risk models in-house takes significant time and resources to create and deploy. Consequently, when these products are finally deployed in market, customers’ requirements may have already changed, creating a never-ending loop.

- Bias and lack of transparency due to siloed customer data

To get a holistic idea of customer behavior, it is vital to consider all of the accounts or products they are connected with. Banks have no single view of their customers in most cases, which hinders accurate decision-making.

The right data is needed for better credit risk models and management

Incorporating the right data architecture and more process automation is crucial to ensure accurate credit risk management. SMBs today seek real-time solutions with rapid decisions. If the data that is the driving factor for these decisions is incompatible, bad, or not efficiently connected, the data cannot be used for decisioning. Advances in data and data analytics lead to new, highly performative credit decisioning models that enable banks to define more precise eligibility parameters and thereby more accurately and rapidly determine creditworthy customers.

In fact, research by McKinsey states that the banks that have implemented next-gen data-driven credit modules have already witnessed many benefits, including

- 5–15% revenue increase through lower acquisition costs, higher acceptance rates, and better customer experience

- 40% reduction in credit loss rates

- 20–40% efficiency gains

The research further states that with these improved models for credit decisioning, a bank with approximately $50B in assets from SMBs can potentially see $100–200M of additional profit. These are highly encouraging numbers for FIs looking to embrace this opportunity.

In Part 2 of #NextGenCreditDecisioning, we will explore how FIs can incorporate next-gen credit decisioning models to leverage open banking for speedy, accurate, and more reliable credit decisions and underwriting and faster loan disbursals.