Open Banking for SMB Lenders

Waves of digitization in the SMB lending industry have allowed financial institutions (FIs) to leave behind traditional lending models. However, there remains a lot of untapped potential for delivering better customer experience and faster credit. Until recently, FIs have relied on dated systems with pre-packaged lending products and a one-size-fits-all approach, resulting in lengthy processes and delayed credit decisions.

Today, we live in the era of instant access. In response to rising demand among SMB customers, FIs need to provide a mechanism that enables smooth, accurate, and quick checks of creditworthiness without requiring physical presence.

Innovative technologies such as AI combined with open banking in the financial services industry allow FIs to bridge the gap between the services they provide and what their customers want. Open banking lets customers share their latest and most relevant financial data with FIs via trusted third-party application programming interfaces (APIs). Lenders thus get access to more enriched financial data for fast-tracking the underwriting process.

By giving customers control of their financial data and enabling lenders to offer more cost-effective, innovative, and personalized services with data-driven strategies, open banking open up many avenues to profitable SMB lending. In this blog, we dive deeper – into what open banking is and how FIs can collaborate with fintech partners to monetize on these platforms.

What is Open Banking?

Open banking is an emerging practice where customers give third-party companies access to their financial data. These companies collect and analyze all the data to enable FIs to offer improved, hyper-personalized, faster, and more flexible lending products.

Fintech lenders aim to position themselves ahead of competitors by solving the most pressing customer challenges. On the other hand, traditional lenders are not typically known for their speed, efficiency, or cost. So, while these third-party fintech companies are developing better lending products, FIs must also improve their offerings or create fruitful partnerships to stay ahead of the curve.

Credit Scoring with Open Banking

Traditional credit scoring considers the customers’ accounts, loans, and income to determine their creditworthiness. In the 21st century, this information is insufficient to make accurate and complete credit decisions. With this limited data set, FIs often miss out on serving a section of SMB customers who are overlooked due to poor credit scores or insufficient credit history.

On the other hand, open banking credit scoring provides FIs with a wide set of data that can help them understand the SMBs’ financial health beyond their regular complexities. Real-time access to the latest data allows FIs to make deeper, fairer, and faster credit decisions. Open banking eliminates the need for tedious manual underwriting processes. These streamlined, automated, and more inclusive lending processes allow FIs to significantly improve their customer experience and gain a competitive edge.

How SMB customers are embracing Open Banking

Until now, large banks have been the gatekeepers of confidential customer financial data such as accounts or loan information. However, open banking has opened up a world of credit opportunities for SMBs.

SMB customers actively look for lenders that consider the bigger picture of their business beyond traditional bank data. A more holistic view of their financials with 360-degree data allows personalized loans and faster approvals at better rates and terms. It is a value exchange for SMBs in return for a better credit evaluation, convenience, speed, cost savings, and freedom from time-consuming paperwork and research.

Benefits of Open Banking

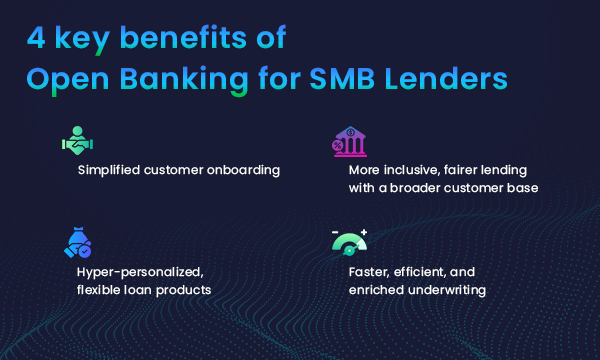

Open banking allows FIs to scale asset generation, reduce operational costs, and deliver a superior customer experience. Some other lucrative benefits include:

1. Simplified customer onboarding

SMB customers can be quickly onboarded without cumbersome paperwork for account details, KYC/KYB verification, etc. Accessing customer data directly from their banks significantly reduces and simplifies the onboarding time, and eliminating manual processing and errors, yielding a much higher conversion rate.

2. Faster, unbiased, efficient, and enriched underwriting

Since open banking is always up-to-the-minute until the final loan approval, FIs can better mitigate risks and give faster credit decisions. When SMBs give access to their financial data, FIs receive an aggregated view of categorized items such as income, investments, spending behavior, and more. This on-demand, real-time data enables them to analyze and verify income instantly. AI-based automated underwriting eliminates the risk of unintended bias, helping FIs bridge the gap for underserved SMBs. And with instant verification without manual processes, FIs can reduce costs and risks, enabling better loan rates.

3. Hyper-personalized, flexible loan products

With time, as FIs gain more granular insights into their customers’ financial life, they can introduce more proactive funding opportunities, such as automated top-up loans. Additionally, since risk is reduced for lenders and borrowers, there is more room for customized products with flexible terms. FIs can recognize the needs of their customers and instantly build products to solve their challenges.

4. More inclusive, fairer lending with a broader customer base

By eliminating tedious manual processes, open banking enables FIs to make quicker, more informed, and more accurate credit decisions while fostering financial inclusion. FIs can serve businesses with limited credit histories while providing a deeper insight into their finances for mitigating risks.

Leverage the power of Open Banking capabilities with CredAcc’s no-code LOS

Open banking has set the transformation of SMB lending in motion. In this era of digitization and personalization, SMB lenders must embrace open banking technology to stand out in an industry historically known for complex processes and costly services. CredAcc’s highly configurable, no-code LOS comes pre-integrated with market-leading third-party open banking modules.

With our automated KYC/KYB, bank statement, credit bureau data, identity verification and authentication, and automated tax form fetching and processing, FIs can significantly reduce OPEX and processing time. CredAcc’s end-to-end automated platform is assisted by verification and operation modules for enriched applications and faster decisioning. This allows FIs to perform complex data spreading and create custom templates and workflows for more enriched and efficient underwriting.

Learn how CredAcc can help your institution with Section 1071 compliance