Build vs. Buy in Loan Origination Systems: Why No-Code Solutions Are Shaping the Future of MSME Lending

For MSME lenders, selecting the right Loan Origination System (LOS) is essential for operational efficiency and competitiveness. The decision between building a custom solution or purchasing a pre-built system has always been challenging. Custom-built systems offer control and full customization but come with high costs, long timelines, and ongoing resource needs. On the other hand, off-the-shelf systems provide faster deployment and lower initial costs but often lack the flexibility required to meet the unique needs of MSMEs.

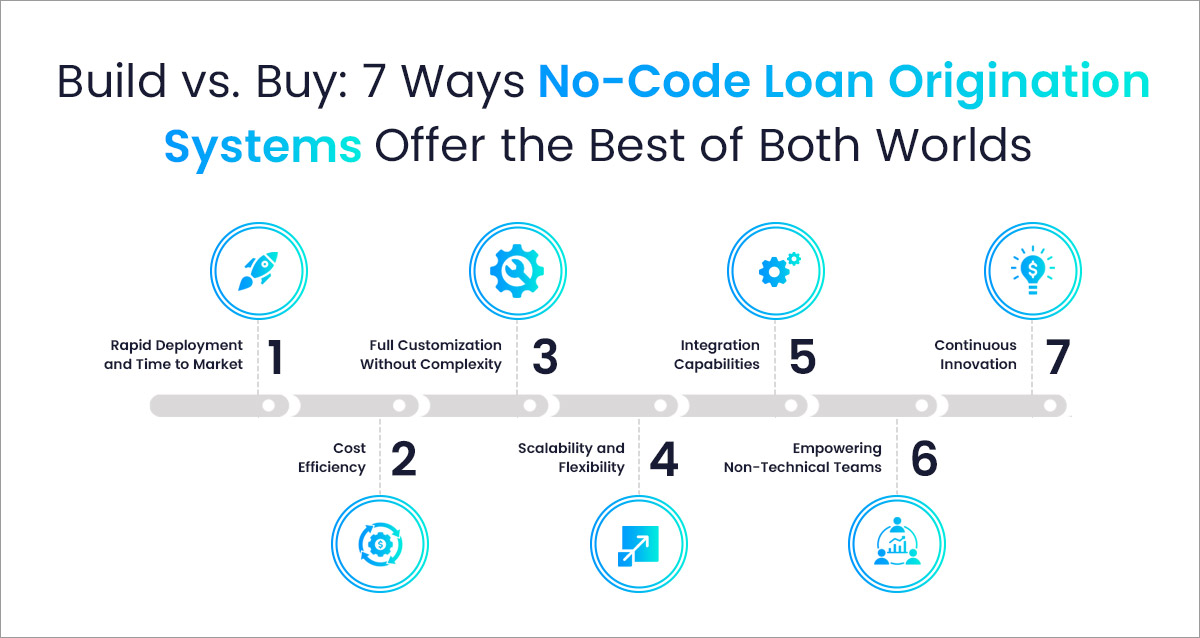

How No-Code Solutions Offer the Best of Both Worlds

No-code platforms have emerged as a compelling solution that combines the best aspects of both traditional approaches. No-code Loan Origination Systems offer the speed and cost-effectiveness of pre-built systems while still providing the customization and flexibility typically associated with custom development. These platforms enable MSME lenders to design, implement, and modify their LOS without the need for extensive coding or IT resources. With no-code solutions, lenders can quickly deploy systems that are adaptable to market demands, minimizing development time and costs.

What is Build vs. Buy for Loan Origination Systems?

The Build vs. Buy decision for Loan Origination Systems revolves around whether a lender should create a custom system tailored to their specific business needs (Build) or purchase a pre-configured, off-the-shelf solution from a vendor (Buy). This decision directly impacts cost, time to market, scalability, and customization—critical factors for MSME lenders.

Building a Custom Loan Origination System

Building a custom LOS means developing a solution from scratch or heavily modifying an existing system to meet the lender’s specific requirements. This process usually involves in-house development teams or third-party providers.

Pros of Building:

- Complete Customization: The system is tailored to the lender’s business model, workflows, compliance needs, and integrations with other systems, ensuring it perfectly aligns with the lender’s processes.

- Control Over Features: Lenders retain full control over the system’s features, design, and updates, making it easier to implement new capabilities as needed.

- Scalability: Custom-built systems are designed to grow with the business, providing flexibility for future expansion and new loan products.

Cons of Building:

- High Costs: Custom development requires significant investment in resources, infrastructure, development, testing, and long-term maintenance. These costs can escalate, particularly with system updates and ongoing improvements.

- Long Development Time: Building a custom system can take months or even years to implement, delaying the time to launch and making it challenging to meet immediate needs.

- Resource-Intensive: In-house development requires dedicated IT teams, and ongoing updates and troubleshooting can strain internal resources.

Buying an Off-the-Shelf Loan Origination System

Buying an off-the-shelf LOS involves selecting a pre-configured solution ready to deploy and offering standard features most lenders require. These systems are typically faster and easier to implement than custom-built systems.

Pros of Buying:

- Faster Implementation: Off-the-shelf systems are pre-built and tested, allowing lenders to deploy the solution quickly and start using it almost immediately.

- Lower Upfront Costs: Purchasing a pre-built system generally incurs lower initial costs compared to building a custom solution, making it more cost-effective for MSME lenders.

- Proven Features: These systems come with industry-standard features and are often aligned with regulatory requirements, reducing the risk of non-compliance.

Cons of Buying:

- Limited Customization: Off-the-shelf systems may not fully address unique business requirements. Customization options are often limited, making it difficult for MSME lenders to meet specific operational needs.

- Vendor Lock-In: Lenders may become dependent on the vendor for future updates and support, which can limit flexibility if the vendor’s roadmap doesn’t align with evolving business needs.

- Inflexibility for Growth: As business processes change or expand, an off-the-shelf system may not adapt easily to new requirements, leading to inefficiencies or costly workarounds.

No-Code Loan Origination System: Combining the Best of Build and Buy

No-code Loan Origination Systems combine the best features of both custom-built and off-the-shelf solutions. These platforms allow MSME lenders to design, implement, and modify their systems without needing extensive coding skills. No-code platforms are customizable and can integrate with third-party services, enabling lenders to meet specific needs without the complexity of traditional development.

Key Advantages for MSME Lenders

- Rapid Deployment and Time to Market

No-code platforms allow MSME lenders to deploy a fully functional Loan Origination System in weeks, compared to the months or years required for custom-built solutions. This speed is crucial for staying responsive to market changes and regulatory updates. - Cost Efficiency

Unlike custom systems, no-code platforms reduce both upfront and long-term costs by eliminating the need for extensive IT resources, development teams, and system maintenance. This makes it an ideal solution for MSME lenders looking to maximize their budgets. - Full Customization Without Complexity

No-code platforms offer a high degree of customization without requiring specialized coding skills. Lenders can easily modify loan application forms, workflows, and integrations to suit their specific business needs. - Scalability and Flexibility

As MSME lenders grow, no-code LOS platforms can easily scale to accommodate increased loan volumes, new products, or changing regulatory requirements without major overhauls. - Integration Capabilities

Lenders frequently face challenges when integrating new software with their existing technology, such as credit bureaus, core banking systems, and payment gateways. No-code platforms utilize API-driven structures, allowing for smooth integration with third-party services and current systems. This improves data flow, enhances the borrower experience, and boosts operational efficiency. - Empowering Non-Technical Teams

With no-code platforms, business teams can take control of the system’s design and updates without waiting for IT intervention. This empowers loan officers and compliance teams to quickly manage workflows and make adjustments. - Continuous Innovation

No-code platforms support ongoing innovation, allowing lenders to quickly adapt to market trends, regulatory changes, or customer demands without the delays associated with traditional development cycles.

Conclusion: Embracing the Future of MSME Lending with No-Code Loan Origination System

The decision between build vs. buy is often complex for lenders, with each approach offering its own advantages and drawbacks. No-code solutions effectively bridge the gap between building a custom system and buying a pre-built one, offering the flexibility of a custom build with the efficiency of off-the-shelf solutions. They enable rapid deployment, easy scalability, and seamless integration with existing systems—all while reducing costs and dependence on IT teams.

This hybrid approach allows lenders to enjoy pre-built functionalities while tailoring features to meet specific operational and regulatory needs. It empowers lenders to remain agile, competitive, and future-ready without sacrificing efficiency or innovation.

For Indian Banks & NBFCs, CredAcc’s end-to-end no-code Loan Origination & Loan Management System offers the perfect balance – it helps lenders tackle unique challenges, scale quickly, and drive growth.

Interested in learning how a ‘build and buy’ approach can enhance your lending platform? Book a demo to discover a tailored solution for your business that combines flexibility and efficiency.