Why No-Code Platforms Will Power the Future of Supply Chain Finance Lending in India

For years, supply chain finance in India has operated within the constraints of technology not built for it. Lenders adapted generic loan systems to fit anchor-led programs, rigid dealer or vendor journeys into fixed workflows, and worked around repayment models these platforms never accounted for. It worked, until it didn’t.

As SCF lending expands deeper into the MSME ecosystem, those workarounds are no longer sustainable. Each anchor brings a different structure. Each borrower segment needs a different journey. And each invoice carries its own risk and repayment profile. No amount of configuration on a traditional system can match that pace or precision.

This is where no-code platforms change the equation, not by simplifying SCF, but by making it possible to design and manage its complexity at scale. These systems enable lenders to build, deploy, and govern SCF products without writing code, while handling all the operational, underwriting, and repayment requirements that anchor-driven finance demands.

In this blog, we examine why Indian banks and NBFCs are turning to no-code platforms for SCF lending and what capabilities these systems need to deliver real value, not just speed.

Why Supply Chain Finance Lending Is Technically Complex, Especially in India

At first glance, supply chain finance appears straightforward: finance an invoice, receive repayment on the due date. But for Indian lenders managing these programs at scale, the real challenge lies in the details, most of which traditional loan systems aren’t equipped to handle.

The complexity of SCF in India is structural, operational, and regulatory:

- Anchor-led program design: SCF in India revolves around anchors, which are typically large corporates or aggregators that influence repayment behavior, verify invoices, and often drive onboarding. Each anchor comes with unique workflows, hierarchies, and data formats that legacy systems struggle to adapt to.

- Borrowers across different tiers and formats: Indian SCF programs often involve vendors, distributors, dealers, and even sub-dealers. Each segment has different levels of documentation, credit readiness, and transaction flow. Managing these journeys through a single, rigid system creates delays and risks.

- Invoice-linked lending with dynamic limits: Credit lines aren’t static. They shift based on live receivables, anchor approvals, and transaction history. Lenders need systems that can ingest data, often from GST returns or ERP uploads, and recalculate drawing power without manual effort.

- Non-standard repayment structures: Many repayments are milestone-linked, buyer-triggered, or partially settled, especially in vendor and project-based financing. This requires a loan management system that supports conditional logic and real-time reconciliation.

- High frequency, low ticket volumes: Thousands of invoices, often for ₹50,000–₹5,00,000, need to be underwritten, booked, and tracked, making automation essential. Manual handling is neither scalable nor compliant.

- Local data, compliance, and reporting requirements: Indian lenders must comply with RBI norms on exposure limits, reporting, and system auditability, none of which are native to generic loan software.

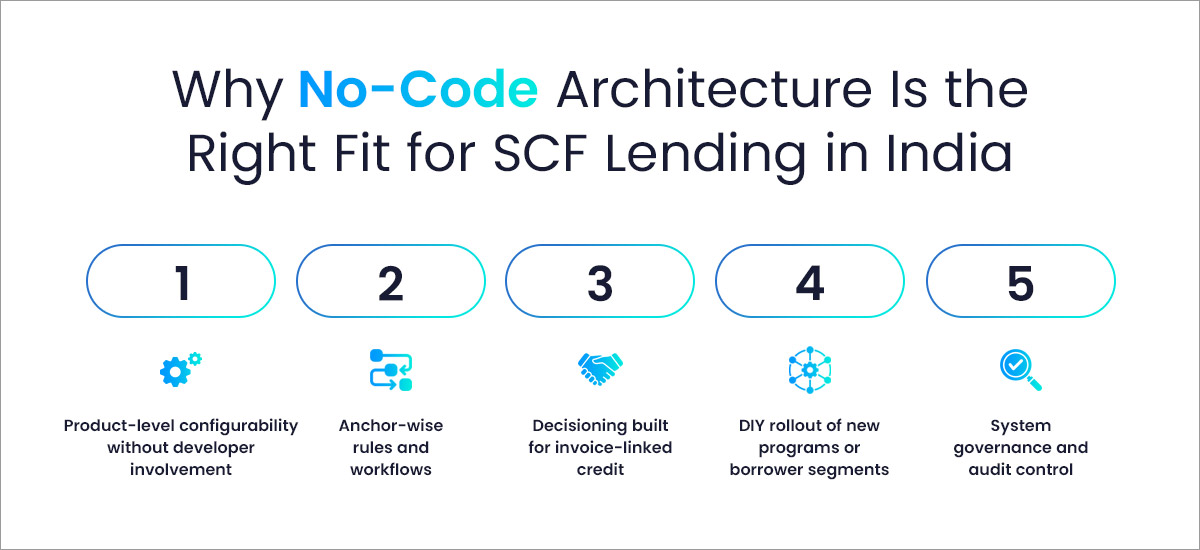

Why No-Code Architecture Is the Right Fit for SCF Lending in India

Most loan platforms weren’t built for supply chain finance. And even when they’re repurposed for SCF, every new anchor, product variant, or repayment model becomes a custom project—costly to build and slow to scale. This is where no-code architecture fundamentally shifts what lenders can do.

A no-code SCF platform doesn’t simplify the lending process. It gives lenders the flexibility to design it on their own terms. Without depending on IT teams or vendor timelines, banks and NBFCs can build and adapt SCF workflows that mirror the realities of their borrowers, anchors, and risk policies.

Here’s why that matters in the Indian context:

- Product-level configurability without developer involvement: Whether it’s vendor finance for auto ancillaries or dealer finance for FMCG, lenders can configure onboarding journeys, required fields, validations, and disbursement logic in just a few clicks—no coding required.

- Anchor-wise rules and workflows: Set custom underwriting parameters, approval hierarchies, or invoice verification steps based on anchor profiles or internal risk classification.

- Decisioning built for invoice-linked credit: Use rule engines, decision trees, and scoring models to automate approvals based on receivable data, buyer ratings, or past payment behavior. Build logic for drawing power calculations that update in real-time.

- DIY rollout of new programs or borrower segments: Launch a new SCF product or onboard a new anchor with customized workflows in days, not quarters. No-code platforms reduce rollout timelines from months to weeks by removing the need for software development cycles.

- System governance and audit control: Every field, rule, and action is logged, tracked, and versioned. Compliance and IT teams can review configurations without combing through codebases or vendor change logs.

This level of control and responsiveness simply isn’t possible with legacy platforms or one-size-fits-all lending tools. For lenders managing dynamic SCF programs across multiple anchors and borrower types, no-code software offers something rare in financial technology: speed and precision, without compromise.

What to Look for in a Modern No-Code SCF Loan Origination System

A loan origination system designed for supply chain finance needs to do far more than process applications. It should enable lenders to manage complex, high-volume, multi-party credit programs while adapting quickly to changing needs, borrower profiles, and evolving credit policies. Here are the key capabilities that define a modern SCF LOS:

- Support for product-specific borrower journeys

The system should enable lenders to tailor onboarding flows for different borrower types such as vendors, dealers, or distributors across multiple channels, including mobile, web portals, and intermediaries. Each path must accommodate distinct documents, data fields, and approval steps. - Direct integration with India’s public data infrastructure

KYB and KYC should be fully digitized, with embedded access to GST and bank statement APIs. This reduces manual verification effort and speeds up onboarding without compromising compliance. - Anchor-wise program configuration

Look for systems that can define workflows, invoice validation rules, repayment behavior, and settlement logic based on anchor-specific structures. This includes the ability to involve anchor-side verification without hardcoding processes. - Flexible invoice ingestion from multiple sources

A robust SCF LOS should accept invoice data from uploads, ERP connectors, anchor portals, or GSTN APIs, and validate it using rule-based checks to catch duplicates and link to anchor POs or buyer records. - Underwriting logic that can adapt by segment or program

The platform must enable lenders to build and modify scorecards, eligibility rules, and credit decision engines without requiring development support. This includes adjusting parameters based on geography, borrower profile, or anchor risk appetite. - Digitized offer and document execution

Sanction letters, loan agreements, and consent forms should be generated, signed, and tracked digitally, ensuring both speed and auditability within the same platform. - Stakeholder-specific access and visibility

Modern systems should include dedicated portals for brokers, anchors, borrowers, or sales partners, each with configurable permissions to upload documents, track status, and initiate transactions securely. - Customizable, multi-level approval workflows

Approval journeys should reflect real-world credit processes, with configurable roles for credit, operations, and compliance. The system should support SLA tracking, escalations, and conditional workflows.

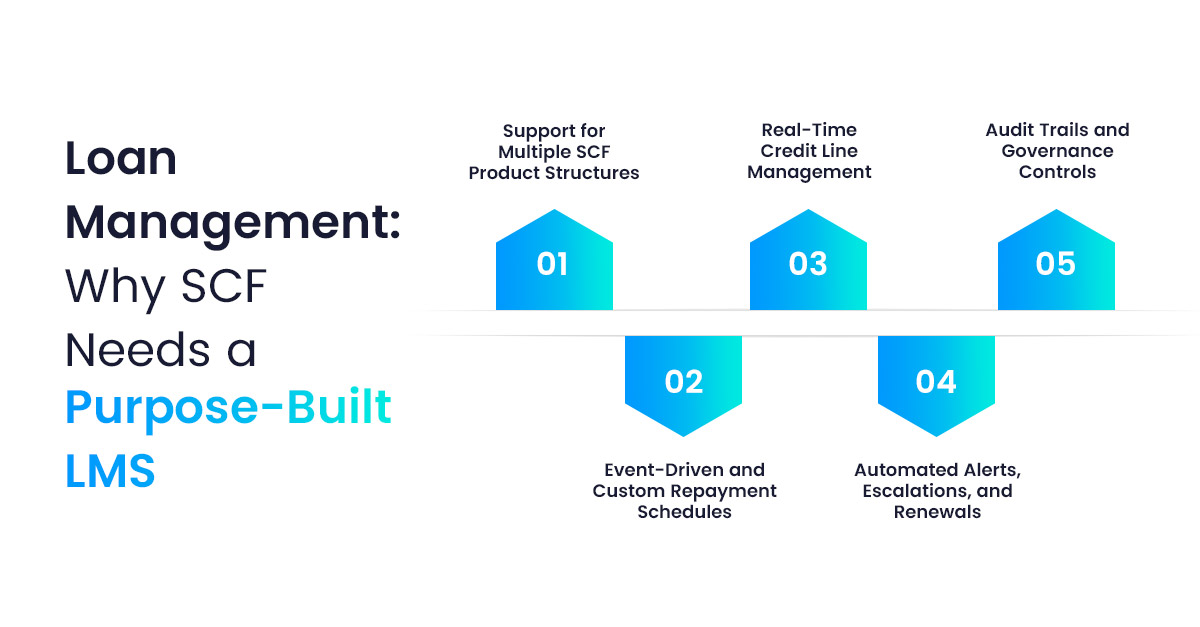

Loan Management: Why SCF Needs a Purpose-Built LMS

In supply chain finance lending, what happens after disbursal is just as critical, especially when repayments aren’t uniform, credit lines are dynamic, and anchors play a role in collections. A generic LMS built for term loans or EMI-based products can’t accommodate the operational complexity of SCF.

A purpose-built SCF Loan Management System (LMS) is designed to handle this post-sanction lifecycle with the flexibility, granularity, and automation lenders need.

- Support for Multiple SCF Product Structures

Different types of supply chain finance products come with their own repayment logic, disbursement patterns, and ledger behavior. The LMS must be able to manage these differences at scale.

- Event-Driven and Custom Repayment Schedules

Repayments aren’t tied to fixed dates. They may be based on invoice maturity, anchor payment receipt, milestone completion, or rolling limits. The LMS should handle partial settlements, early payments, top-ups, and renewals with automated rule execution.

- Real-Time Credit Line Management

Credit utilization should adjust dynamically as invoices are uploaded, payments are received, or limits are reset. The system must automatically calculate available drawing power, linked to anchor, borrower, and product rules.

- Automated Alerts, Escalations, and Renewals

Trigger alerts for repayment deadlines, utilization breaches, document expiries, or anchor actions. Build rule-based workflows for follow-ups, grace periods, and credit line renewals.

- Audit Trails and Governance Controls

Every transaction, adjustment, or action, whether automated or manual, should be logged for audit. Lenders can enforce role-based access, approval hierarchies, and compliance workflows directly within the platform.

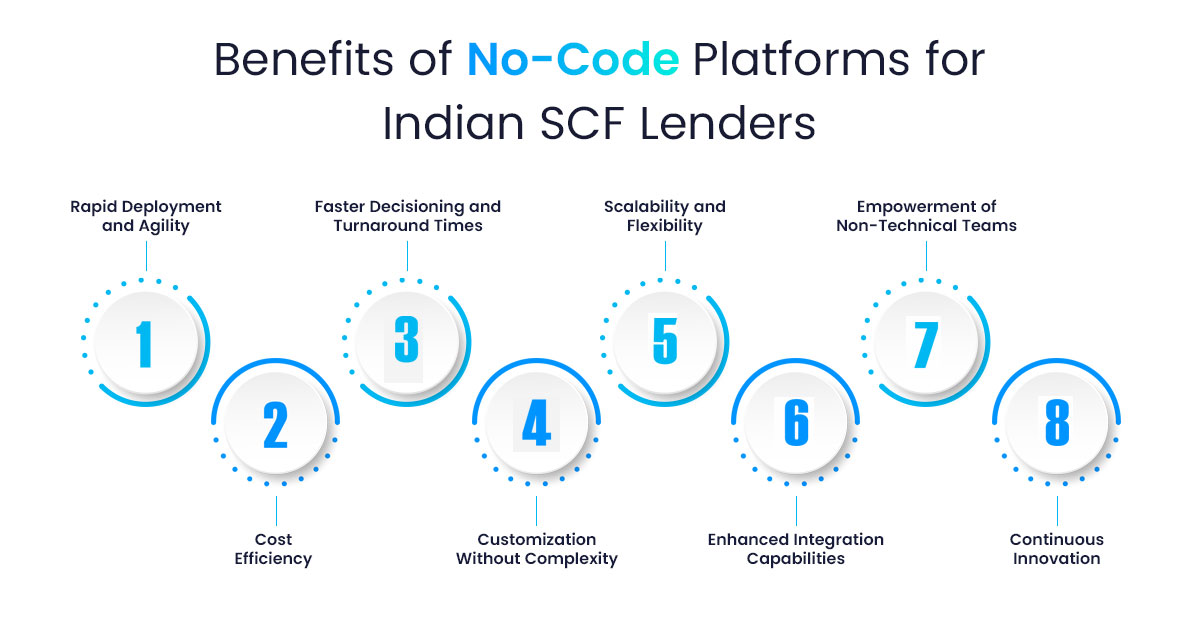

Benefits of No-Code Platforms for Indian SCF Lenders

- Rapid Deployment and Agility: No-code platforms enable MSME lenders to implement SCF solutions quickly, allowing them to respond to market changes and regulatory updates with minimal delay.

- Cost Efficiency: By eliminating the need for extensive IT resources and development teams, no-code platforms reduce both initial and ongoing costs, making them a cost-effective solution for lenders.

- Faster Decisioning and Turnaround Times: With pre-integrated data sources and rule-based underwriting, lenders can process credit lines in hours instead of days. That means anchors stay engaged, and MSMEs gain access to working capital when it matters most.

- Customization Without Complexity: Lenders can easily tailor loan workflows, integrations, and borrower interactions to meet specific business needs without requiring specialized coding skills.

- Scalability and Flexibility: As lending volumes increase, no-code platforms can scale to handle more transactions, new products, or changing regulations, all without major system overhauls.

- Enhanced Integration Capabilities: The platform’s API-driven structure enables easier integration with existing systems, such as credit bureaus, core banking systems, and payment gateways, thereby improving data flow and operational efficiency.

- Empowerment of Non-Technical Teams: No-code platforms empower business teams to manage and update workflows independently, thereby reducing their reliance on IT support and enhancing operational efficiency.

- Continuous Innovation: No-code platforms allow lenders to quickly adapt to market demands, regulatory changes, and customer preferences, ensuring they remain competitive and responsive to new opportunities.

Conclusion

Supply chain finance in India has evolved far beyond the scope of large corporates and a few key suppliers. Today, it’s a dynamic, cross-industry solution that spans diverse markets, each with its own unique structures, risks, and expectations. For lenders, this growth has highlighted a significant challenge: traditional platforms can’t handle this level of complexity, and custom-built systems are too slow to adapt.

The answer isn’t more code – it’s more control. The ability to configure products by anchor, change workflows in real time, underwrite using live data, and manage repayments that don’t follow a standard EMI schedule. All without relying on IT teams to patch the system every time the business moves.

CredAcc’s no-code SCF LOS and LMS is specifically designed for the Indian market, it empowers lenders to manage everything from digital onboarding to dynamic credit lines and real-time limit recalculations – without any coding. The platform integrates seamlessly with essential Indian data sources and credit bureaus, offering role-based workflows, decision engines, and audit trails.

Book a demo to discover how CredAcc can help your SCF lending business grow faster.