Credit underwriting automation for banks: Modernizing MSME underwriting without replacing your core systems

If you run MSME lending at scale, you know the paradox: the hard part isn’t deciding, it’s getting to a decision that’s consistent, explainable, and easy to move through the system. A single proposal can arrive with a mix of PDFs, bank statement extracts, GST details, bureau outputs, field notes, and clarifications that sit across emails and spreadsheets. Each “small” gap doesn’t just slow one file; it creates a pattern – rework, handoffs, and exceptions that are difficult to track and even harder to standardise across branches and channels.

This matters because MSMEs are too central to treat underwriting friction as a cost of doing business: they contribute a meaningful share of India’s output and exports, and yet formal credit still meets only a fraction of demand, leaving a large gap. The question isn’t whether to modernise, it’s how to do it without destabilising what already works. This article lays out a practical approach: the specific challenges that slow MSME underwriting and how a configurable layer can modernise underwriting without replacing your core systems.

Credit underwriting automation: what it actually means in a bank setting

Underwriting automation standardises how an MSME loan file moves from application to decision, so routine steps occur the same way every time, with fewer handoffs and less rework. It doesn’t replace credit decision-making. It creates the conditions for better decision-making.

- Automation handles repeatable work: collecting information in a structured format, validating it, running required checks, applying defined policy rules, routing the file, and recording the trail.

- Humans handle credit decisions that need context: approving deviations, setting conditions, adjusting terms, or making calls where the file is unusual, borderline, or needs an exception.

A practical way to look at it is four connected blocks:

1) Intake: make the file decision-ready

- Capture borrower, business, and facility details in a consistent structure

- Flag missing fields and mismatches early (so gaps don’t surface late)

- Keep documents and data organised the same way across branches and channels

2) Checks: run required verifications consistently

- Trigger the right checks based on product and segment

- Standardise what “complete” means before the file reaches credit

- Route only genuine gaps for review instead of repeated back-and-forth

3) Policy application: apply defined rules consistently

- Run eligibility and limit checks based on approved policy

- Produce clear outcomes: pass, fail, or requires approval

- Treat deviations as a controlled process with thresholds and approvals

4) Controls and tracking: keep the decision defensible

- Maker-checker approvals and role-based access

- A clear record of decisions, approvals, and changes

- Tracking for conditions precedent and disbursement readiness

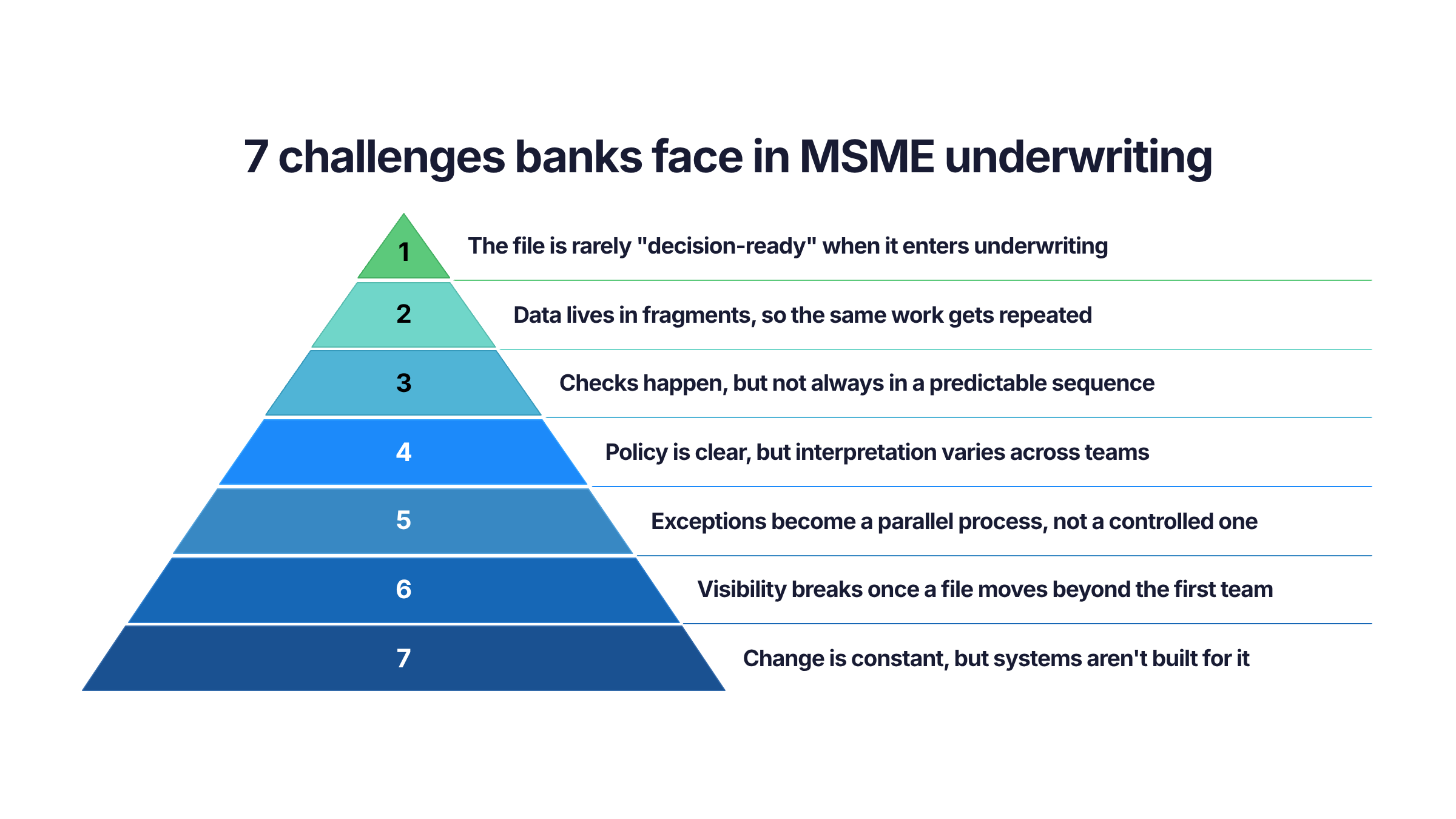

The challenges banks face in MSME underwriting

1) The file is rarely “decision-ready” when it enters underwriting

Even strong borrowers have gaps: missing fields, inconsistent identifiers, unclear facility details, or documents that don’t match the policy’s expectations. The cost isn’t the gap itself, it’s the late discovery of the gap, after the file has already moved across teams.

2) Data lives in fragments, so the same work gets repeated

Sales, ops, and credit teams often reconstruct the file in their own formats. When borrower data, banking data, and business information aren’t standardised early, every downstream step slows down because validation and reconciliation are repeated.

3) Checks happen, but not always in a predictable sequence

Different channels trigger different behaviours. Some files go to the bureau early, others late. Some get bank statement reviews before basic validations. When the order of checks varies by team or branch, turnaround time becomes hard to control and easy to distort.

4) Policy is clear, but interpretation varies across teams

MSME policies often have conditions, thresholds, and exceptions. In a manual process, two competent teams can still reach different conclusions about what qualifies as a deviation, what needs approval, and what can be accepted with conditions. This variability is a governance issue as much as an efficiency issue.

5) Exceptions become a parallel process, not a controlled one

Most MSME portfolios rely on exceptions. The problem starts when exceptions are handled via email, phone, and offline notes. Over time, the exception process becomes harder to track, audit, and learn from, so the same exceptions keep resurfacing.

6) Visibility breaks once a file moves beyond the first team

Senior teams usually don’t lack dashboards, they lack reliable stage visibility. When files sit in personal inboxes, spreadsheets, or informal follow-ups, the reason for the delay becomes unclear. Escalations increase, but root causes stay unresolved.

7) Change is constant, but systems aren’t built for it

MSME products evolve: segment criteria, exposure caps, documentation rules, program-based variants, and risk triggers. When each change requires long coordination cycles, banks either delay the change or implement it inconsistently across channels.

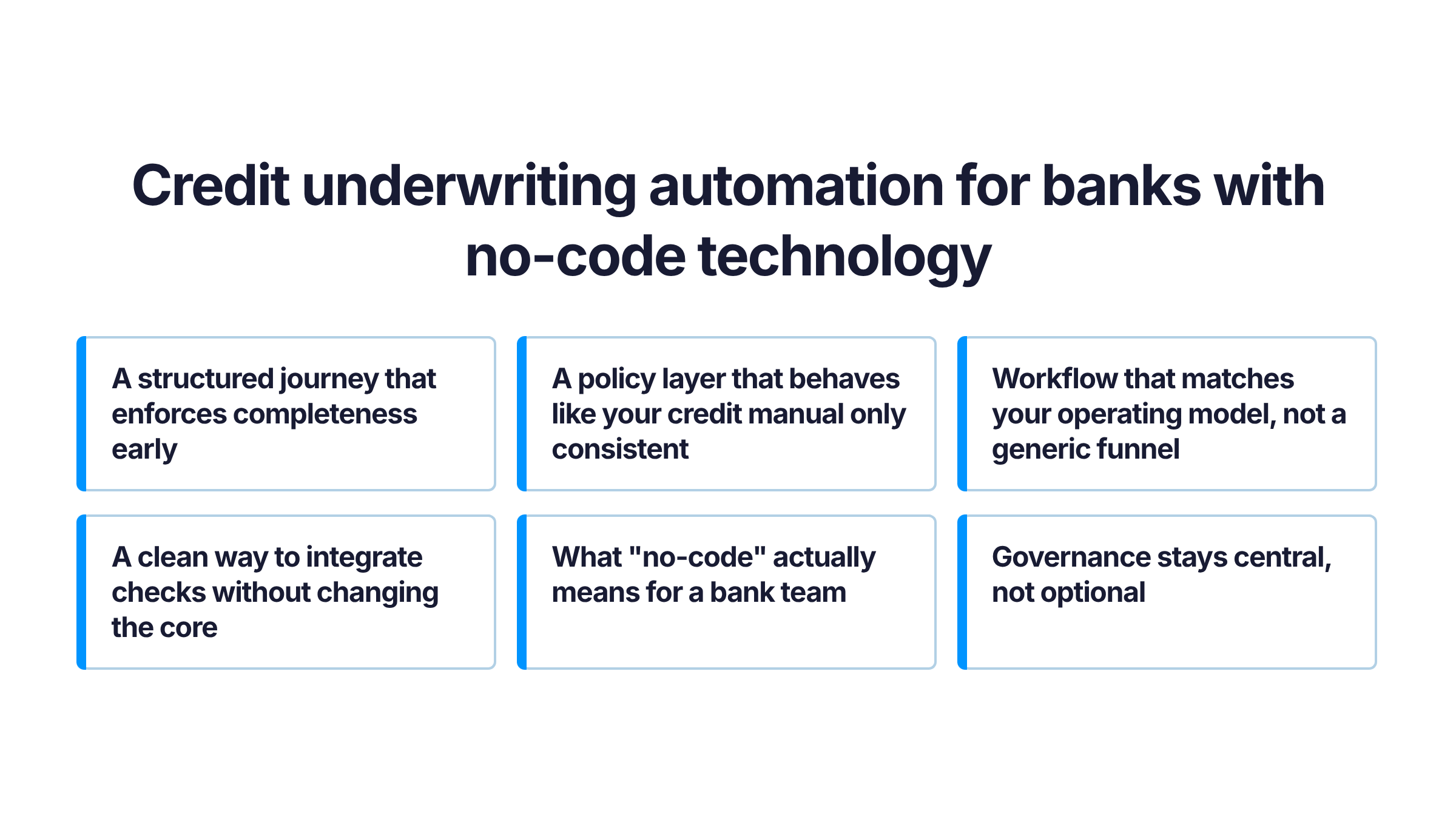

Credit underwriting automation for banks with no-code technology

To solve the challenges above, banks don’t need a new core. They need a configurable underwriting layer that sits around the core and controls the flow of policy + process. The best way to think about this layer is simple: it captures information once, runs checks consistently, routes decisions correctly, and records everything without making everyday policy changes dependent on engineering cycles.

1) A structured journey that enforces completeness early

Instead of underwriting teams discovering gaps mid-way, the automation layer sets a clear standard for what “decision-ready” means:

- guided application capture (same structure across branch, DSA, and digital sourcing)

- built-in validations (missing fields, mismatches, duplicates)

- document requirements tied to product and segment

This reduces late-stage surprises and the back-and-forth that follows.

2) A policy layer that behaves like your credit manual only consistent

Most banks already have the policy logic. The gap is execution at scale. The automation layer converts key policy elements into rules that run the same way every time, such as:

- eligibility criteria, exposure caps, FOIR/DSCR thresholds, LTV constraints

- program-specific conditions and segment-based variations

- deviation thresholds that decide when a file can proceed vs when it must go for approval

Importantly, this doesn’t “auto-approve everything.” It ensures files are moved to humans only when the case truly requires discretion.

3) Workflow that matches your operating model, not a generic funnel

MSME underwriting is multi-team by design. Automation helps by setting up:

- maker-checker paths and approval routing aligned to your delegation of powers

- clear queues for credit, risk, ops, and verification teams

- SLA and stage visibility so a file doesn’t go silent between handoffs

You get control without adding friction.

4) A clean way to integrate checks without changing the core

Underwriting depends on external and internal checks—bureau checks, KYC, bank statements, GST, account data, and internal customer history. The automation layer orchestrates these checks and attaches outputs back to the file in a consistent format, so teams don’t rebuild context at every stage.

5) What “no-code” actually means for a bank team

No-code tech enables business teams to configure frequent changes within guardrails without writing or deploying new code. Typically:

- creating or updating rules (thresholds, conditions, required documents)

- editing workflows (who approves what, when, and with which notes)

- adding product variants (segment tweaks, program overlays)

- updating forms, checklists, and reason codes

The point isn’t speed for its own sake. It’s controlled change, so policy updates don’t turn into long release cycles, and rollout doesn’t become inconsistent across channels.

6) Governance stays central, not optional

A no-code layer only works in banking if it’s built with governance:

- role-based access (who can propose vs approve changes)

- policy versioning (what changed, when, and why)

- testing and controlled rollout (pilot, then scale)

- audit-ready trails for every decision and deviation

Conclusion

Modernising MSME underwriting without replacing your core systems comes down to one thing: making the credit process predictable. When intake is structured, checks run on time, policy is applied consistently across channels, and exceptions follow defined approval routes, underwriting no longer depends on follow-ups or individual interpretation. Your core continues to do what it’s meant to do: record, book, and service, while the underwriting journey becomes easier to scale, govern, and measure.

If you’re evaluating how to build that layer, look for a Loan Origination System that lets you configure the application journey, workflows, and rule-based credit checks without code, while still supporting the realities of MSME files: digitised KYC/KYB, embedded GST/banking data sources, underwriting and operations modules, a decisioning engine with eligibility logic and decision trees, strong audit controls, and clean integration with your existing core for live transactions. CredAcc’s no-code LOS is built specifically around these requirements, so your teams can roll out product variants faster, tighten policy adherence, and keep approvals defensible end-to-end.

Request an LOS walkthrough to see how your current underwriting flow can be mapped, automated, and governed without a core replacement.