Working Capital Lending: Challenges and Opportunities for Indian Banks & NBFCs

Demand for working capital lending is rising across India, particularly among MSMEs and corporate enterprises, but legacy workflows, fragmented data, and increasing compliance requirements make consistent scale hard to achieve.

Take drawing power, typically calculated manually using debtor and stock statements. This painstaking process slows disbursement and increases risk. Then there’s the strain of covenant tracking, collateral margining, and integration with GST or ERP systems, often handled across spreadsheets, emails, and disparate core systems. The result? Friction and bottlenecks.

Meanwhile, NBFCs are navigating tighter regulations, costly funding, and a competitive push into working capital finance in India. Banks, too, must reconcile capital adequacy norms while trying to revive credit growth (reuters.com). All this points to a critical question: how can lenders offer faster, safer working capital solutions without ballooning overhead?

Modernising these lending operations offers a clear path forward: automated drawing power, digital collateral workflows, real-time data integration, and rule-driven compliance. When lenders close these gaps, they not only serve businesses better, they also sharpen their own credit discipline and reduce costs.

What Is Working Capital?

Working capital is the difference between a business’s short-term assets, such as cash, receivables, and inventory, and its short-term liabilities, including payables and loan repayments. It reflects the amount of liquidity the business has to fund its daily operations.

There are different types of working capital, each with its own relevance for credit decisions:

- Permanent working capital: The minimum level needed to keep the business running consistently.

- Temporary or variable working capital: Additional requirements during periods of growth or disruption.

- Seasonal working capital: Short bursts in demand tied to specific cycles like festivals, harvests, or fiscal year-end spikes.

These working capital needs can arise even when the business is profitable. A manufacturer waiting for receivables, a trader stocking up before peak season, or a service provider with monthly outflows but quarterly inflows – all need liquidity support to function smoothly.

For lenders, understanding this structure is essential to assess risk, design suitable credit limits, and support repayment schedules aligned to cash cycles.

Working Capital Loans – Importance and Market Trends for Indian Lenders

Demand for working capital loans has surged among India’s SMEs and mid-sized businesses. As of March 2025, MSME credit has surpassed ₹40 lakh crore, representing a 20% year-on-year increase driven by policy initiatives, digital access, and financial inclusion. The RBI’s recent rate cuts and reduced reserve requirements aim to further lower borrowing costs and support growth among smaller firms.

Beyond credit volume, digital innovation is reshaping working capital finance. Lenders are increasingly using AI, alternative scoring models (such as GST and transaction data), and platforms like TReDS to streamline receivables financing. The Government’s CGTMSE has expanded its guarantee schemes, backing digital platforms and reducing collateral friction.

Why this matters for lenders:

- Scale & efficiency: Technologies like digital lending, TReDS, and AI enable high-volume, low-touch processing, without compromising risk controls.

- Lower default risk: Digital credit scoring and real-time covenant monitoring reduce exposure and improve early-warning capabilities.

- Competitive edge: Lenders that offer fast, frictionless working capital solutions win loyal MSME clients in a crowded marketplace.

In short, working capital lending in India is a dynamic engine of growth. Lenders who invest in smarter execution tools can capture a larger market share, while supporting businesses that increasingly rely on timely and flexible financing.

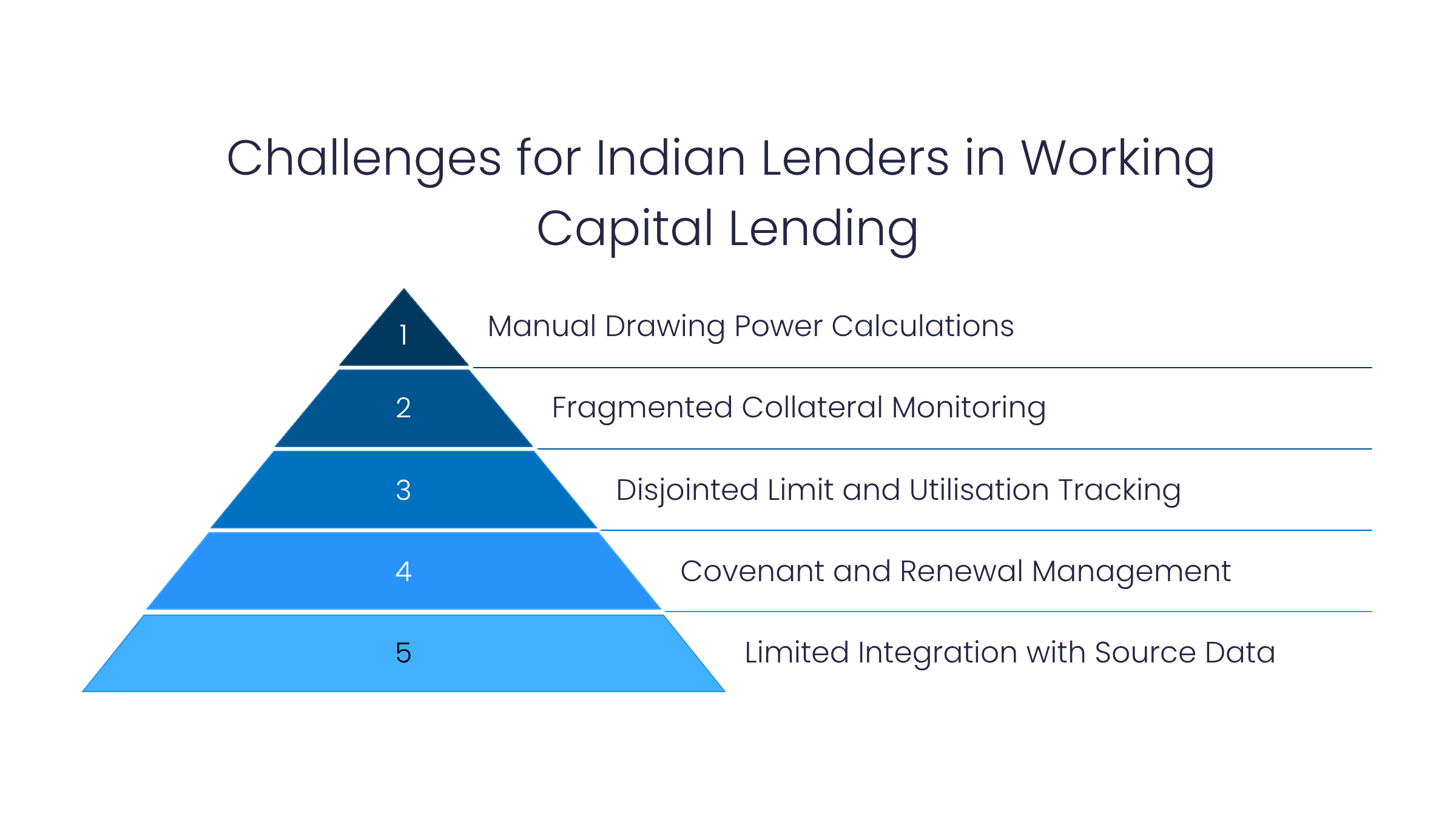

Challenges in Working Capital Lending

Despite growing demand, delivering working capital finance at scale remains a complex challenge. The structure of these loans, often revolving, collateral-backed, and variable in nature, creates a set of operational challenges that most core systems aren’t built to handle.

- Manual Drawing Power Calculations

Drawing power (DP) is the cornerstone of working capital lending, yet it’s still calculated manually by many lenders. Borrowers submit stock and debtor statements in PDF or Excel formats, which credit teams then verify and convert into DP. This creates processing delays, inconsistency in margin application, and frequent errors, especially when volumes rise.

- Fragmented Collateral Monitoring

Working capital loans are often secured by dynamic collateral, such as receivables or inventory, which fluctuates in value. Monitoring these in real time requires integration with ERP, GST, and banking data. Without it, lenders risk overexposure or conservative lending that restricts credit flow.

- Disjointed Limit and Utilisation Tracking

Whether it’s cash credit, overdraft, or a demand loan, lenders struggle to track limit utilization in real-time across multiple accounts and facilities. Unstructured workflows make it difficult to identify overdrawn positions or underutilized limits early.

- Covenant and Renewal Management

Most working capital loans include financial covenants tied to key ratios, such as turnover ratios, current ratios, or asset coverage. However, manually tracking these metrics across thousands of accounts creates compliance gaps. Similarly, renewals often require revalidation of borrower performance, which can become data-heavy and labor-intensive without automation.

- Limited Integration with Source Data

A significant portion of working capital assessment relies on data that resides outside traditional banking systems, such as GST returns, bank statements, and ERP exports. Without direct integration, lenders rely on document uploads and manual checks, resulting in a slow and error-prone process.

These operational inefficiencies directly affect disbursal timelines, portfolio quality, and cost-to-serve. As volumes grow and borrower expectations rise, addressing these issues isn’t just about speed; it’s about risk, compliance, and long-term viability.

What Lenders Need from a Modern Working Capital Lending System

To scale working capital finance effectively, lenders need more than just automation. They need purpose-built systems that accurately reflect the structure, monitoring, and repayment of these loans. Traditional loan management tools often fall short when dealing with revolving limits, fluctuating collateral, or daily interest cycles.

Here’s what a modern system must deliver:

- Digital Onboarding with Verified Financial Data

Lenders should be able to onboard businesses quickly using verified inputs such as GST returns, bank statements, and bureau data without relying on scanned documents and manual checks. This reduces turnaround time and improves data reliability from day one.

- Automated Drawing Power Calculation

Drawing power should update dynamically based on stock and debtor statements, with configurable margins, eligibility filters, and real-time validations. This improves both accuracy and turnaround times – key aspects of sound working capital management.

- Real-Time Collateral Tracking

Whether backed by receivables, inventory, or both, collateral should be monitored continuously. Systems must flag deviations from accepted thresholds, margin shortfalls, or changes in asset quality, providing credit teams with timely signals to act.

- Utilisation and Covenant Monitoring

Usage patterns should be tracked automatically across all sanctioned limits. Built-in rules should monitor covenants such as the turnover ratio or current ratio, and trigger alerts when compliance is at risk. This strengthens control without increasing manual effort.

- Flexible Product Configuration

A single platform should be able to support overdrafts, cash credit, demand loans, and blended structures. Each product should be configurable in terms of repayment logic, interest application, collateral linkage, and limit reset.

- Seamless Integration with Source Systems

Direct integration with GST filings, ERP exports, and bank feeds is essential. It not only improves data quality but also enables lenders to respond more quickly to borrower needs, one of the key benefits of working capital that businesses value.

Benefits of a Modern Working Capital Lending System

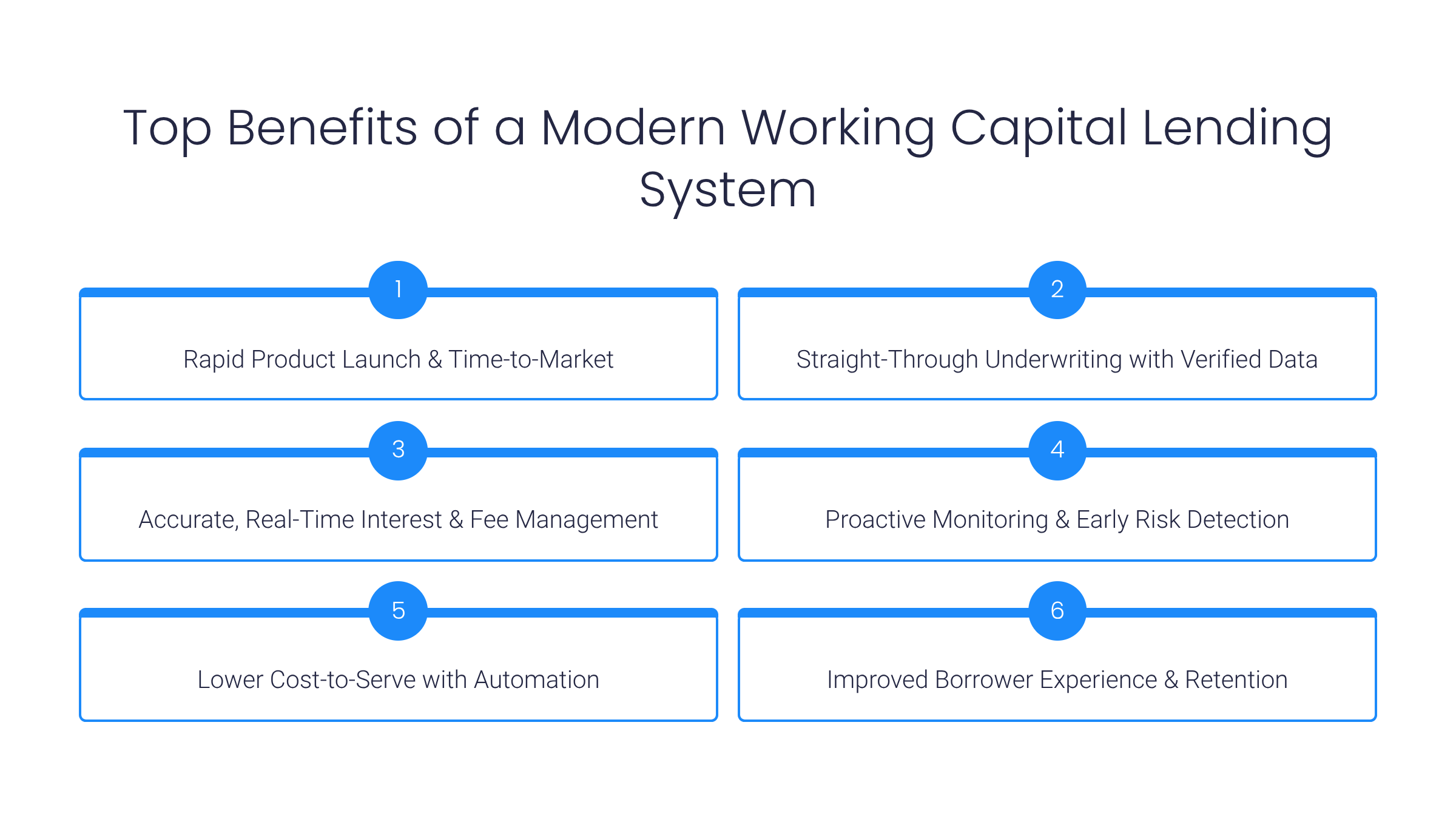

A modern working capital lending system delivers far more than faster processing. It transforms how lenders manage credit risk, operate at scale, and deliver value to business customers.

- Rapid Product Launch & Time-to-Market

With a no-code loan origination system (LOS), lenders can configure and launch cash credit, overdraft, or demand loan products in days rather than months. This agility enables faster response to borrower needs and market shifts.

- Straight-Through Underwriting with Verified Data

Automated underwriting, powered by GST, bank statements, and debtor data, allows for instant calculation of drawing power and credit assessment. This reduces manual checks, improves consistency, and lowers the risk of delinquency.

- Accurate, Real-Time Interest & Fee Management

The system handles daily utilization tracking and applies interest and fees based on actual usage, which is crucial for managing revolving credit lines. This ensures precision and strengthens working capital management at the portfolio level.

- Proactive Monitoring & Early Risk Detection

Real-time dashboards track covenant compliance, collateral values, and limit utilisation. Alerts are automatically triggered when thresholds are breached, giving credit teams time to intervene before issues escalate.

- Lower Cost-to-Serve with Automation

Automated onboarding, documentation, disbursal, and renewals significantly reduce operational load. Lenders can expand their working capital book without scaling credit operations in proportion.

- Improved Borrower Experience & Retention

Faster decisions, fewer document requests, and self-service limit tracking give borrowers a smoother experience. This builds trust, improves retention, and positions lenders as reliable long-term partners for working capital finance.

Rethinking Working Capital Lending for Long-Term Impact

Working capital is more than a line item on a balance sheet – it reflects a business’s ability to keep operating, fulfil orders, and grow steadily. For lenders, offering this form of finance is both a responsibility and an opportunity. It requires a system that matches the complexity of the product and the pace at which businesses move.

As the credit environment evolves, delivering working capital efficiently through real-time insights, accurate limit structures, and reliable automation is becoming a defining capability. It enables lenders to serve more businesses, manage risk better, and make faster, more informed decisions.

CredAcc helps Indian banks & NBFCs bring this capability to life. Our platform is designed to support the operational depth and working capital lending demands, combining automation, flexibility, and data integration in a single, secure, and modular system. Whether you’re looking to improve turnaround times, reduce cost, or strengthen portfolio quality, we offer the tools to make that shift seamless.

Get in touch with our team to see how CredAcc can support your working capital lending business at scale.